Making Information Make Sense

InfoMatters

Category: Information / Topics: History • Information • Statistics • Trends

COVID-19 Perspectives for February 2022

by Stu Johnson

Building article list (this could take a few moments)...

Building article list (this could take a few moments)...Posted: March 66, 2022

Have we seen the last giant gasp of the COVID pandemic as it morphs into an endemic, or are we rushing too quickly to return to normal? What happens in March will answer that question…

Putting the COVID-19 pandemic in perspective (Number 20)

This monthly report was spawned by my interest in making sense of numbers that are often misinterpreted in the media or overwhelming in detail (some would say that these reports are too detailed, but I am trying to give you a picture of how the COVID pandemic in the United States compares with the rest of the world, to give you a sense of perspective).

These reports will continue as long as the pandemic persists around the world.

Report Sections:

• February-at-a-glance

• The Continental View • USA Compared with Other Countries

• COVID Deaths Compared to the Leading Causes of Death in the U.S.

• U.S. COVID Cases versus Vaccinations

• Profile of Monitored Continents & Countries • Scope of This Report

January-at-a-glance

Reminder: you can click on any of the charts to enlarge it. It will open in another tab or window. Close it to return here.

GLOBAL SNAPSHOT

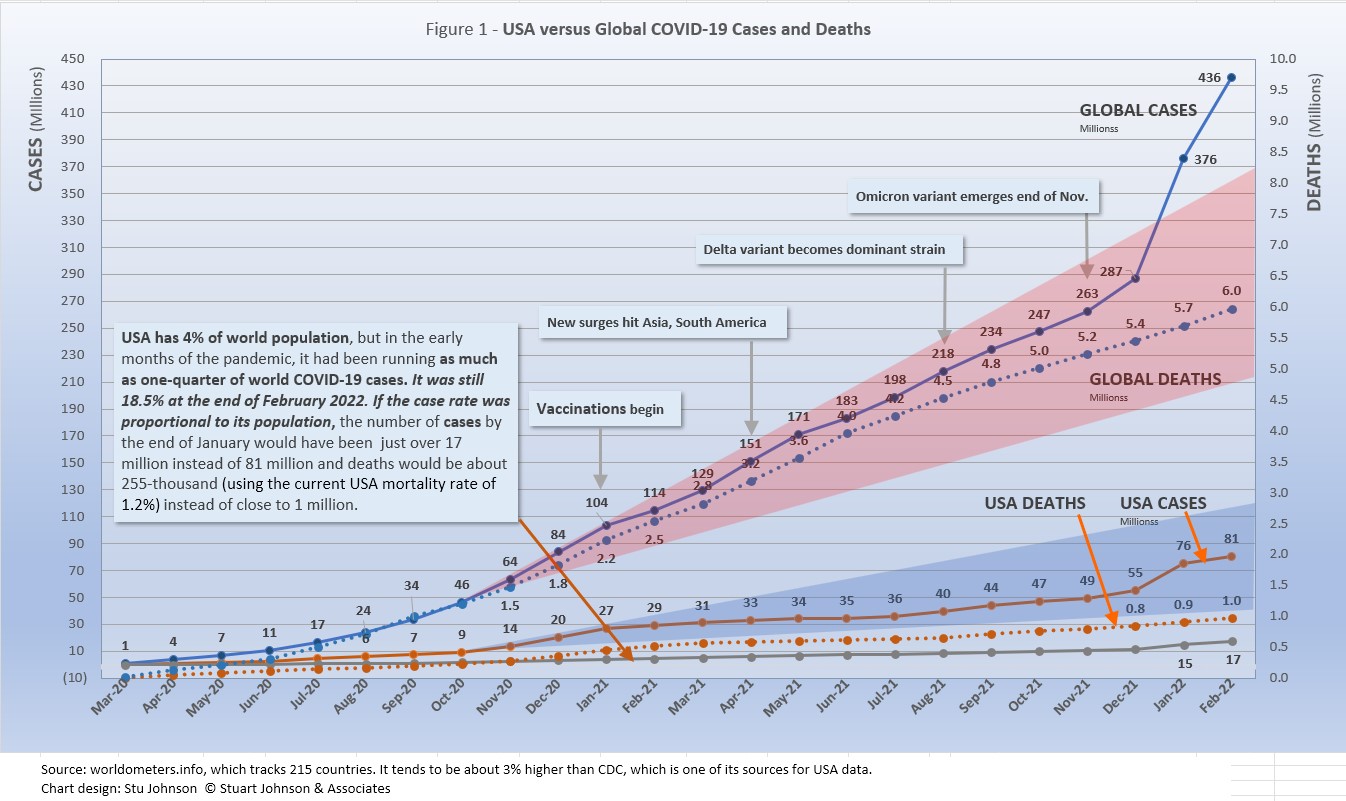

As of this writing, in early March, the attention of the world has turned toward the Russian invasion of Ukraine, while in many places the masks for COVID are coming off. Yet, looking at the February numbers (Figure 1), the Omicron variant was still very active around the world, most notably in Europe and North America. However, with hospitalizations down and mortality rates continuing to fall (because, fortunately, deaths have not kept pace with cases), it does feel like we're finally seining the pandemic's last gasp—while there could be more variants and renewed surges, it appears that COVID may be on its way to becoming endemic, a reality we will continue to deal with, but on a more manageable scale. Let's see if the numbers for February help support that viewpoint.

EXECUTIVE SUMMARY

- Global CASES reached 436-million by the end of February, an 18% increase. That's big, but a little more than half of the huge 31% surge in January. The percentage of the global population with reported cases of COVID-19 rose from 3.6% in December, to 4.8% last month, and ended February at 5.5%. (The 1918 pandemic is generally thought to have infected 25% of the global population).

The red "cone" in Figure 1 above shows a high and low projection of global cases, based on the pace of spread in the first year of COVID-19. The bottom (roughly 190-million represents the trajectory of the lower pace in late summer 2020; the upper (approximately 360-million) represents a continuation of the major surge from November 2020 through January 2021. Even with the delta variant in 2021 was announced with alarm, the global increase in cases stayed within the projection cone. Then came omicron, which hit Europe hard in December 2021, then shot the curve through the projection cone in January, soaring upward by 88-million cases. February slowed slightly, adding another 60-million cases worldwide. That put the curve for global cases about 70-million higher than my projection cone based on the situation a year ago.

- DEATHS from COVID around the world continued to rise at a much slower pace than cases. February deaths were 5% above January, compared to 4% the previous three months. However, if you put a straight edge on the curve from March to June 2021, you will see that the rate of increase in deaths has fallen off significantly.

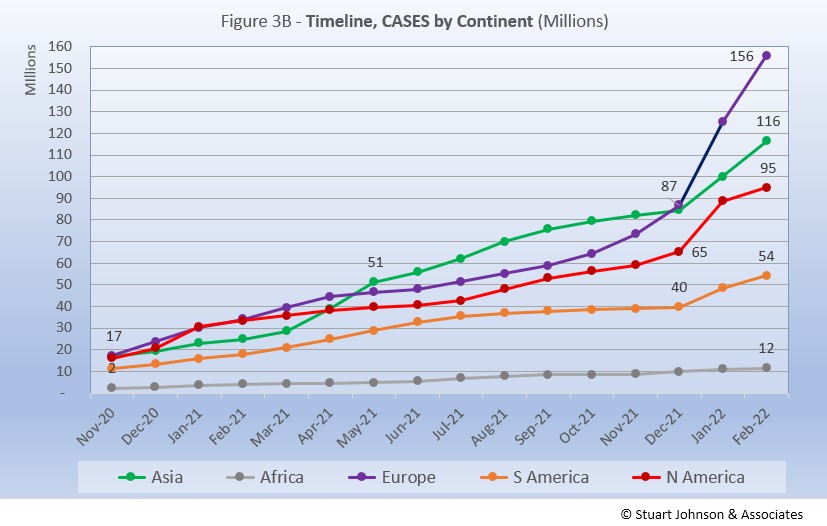

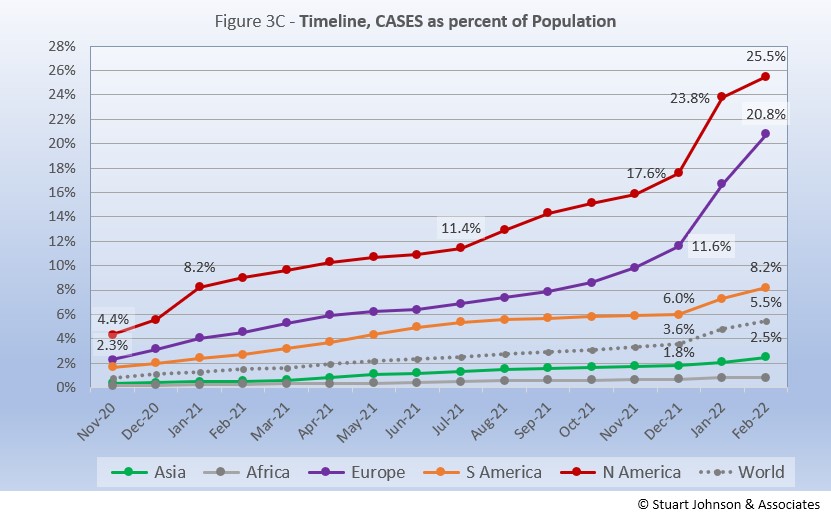

- BY CONTINENT. At the global level, omicron produced a noticeable but relatively small bend in the curve for cases as a proportion of population (Fig. 3C), because Asia and Africa—the two largest continents—barely budged. That was not the case with the other continents. South America, which had been slowing and nearly flat at the end of 2021, bent upwards significantly in January and February. Europe and North America shot upward at a startling rate—Europe from 11.6% of its population having contacted COVID by the end of December to 20.8% by the end of February. North America, far ahead of Europe to begin with, leaped from 17.6% at the end of December, to 23.8% in January, then "slowed" to end February with 25.5% of its population having been reported with COVID since the pandemic began nearly two years earlier—matching the 1918 pandemic in proportion of cases.

- USA continues to lead the world in the number of reported cases and deaths, and while it leads the world in the number of COVID tests its vaccination rate remains lackluster compared to South America.

USA cases soared 37% in January, to 75.6-million or nearly 23% of the population, then February slowed, bringing the proportion to 24.3% of its population. At the same time, four European countries that had been tracking fairly close to USA began to move even higher when omicron struck, increasing their spread even more in February, with Netherlands the highest, at 37% of its population reported with COVID.

The blue projection cone surrounding USA cases in Figure 1, based on the same timeline as the global cone described above, stretched from 35 to 115 million cases, with the curve for cases staying well within those bounds. Cases in USA flattened significantly from January through July 2021 after vaccinations became available, Then, it rose slightly through November with a combination of delta and vaccine resistance. Omicron produced a serious upward bend last month, but slowed in February, ending the month at about the mid-point in the cone.

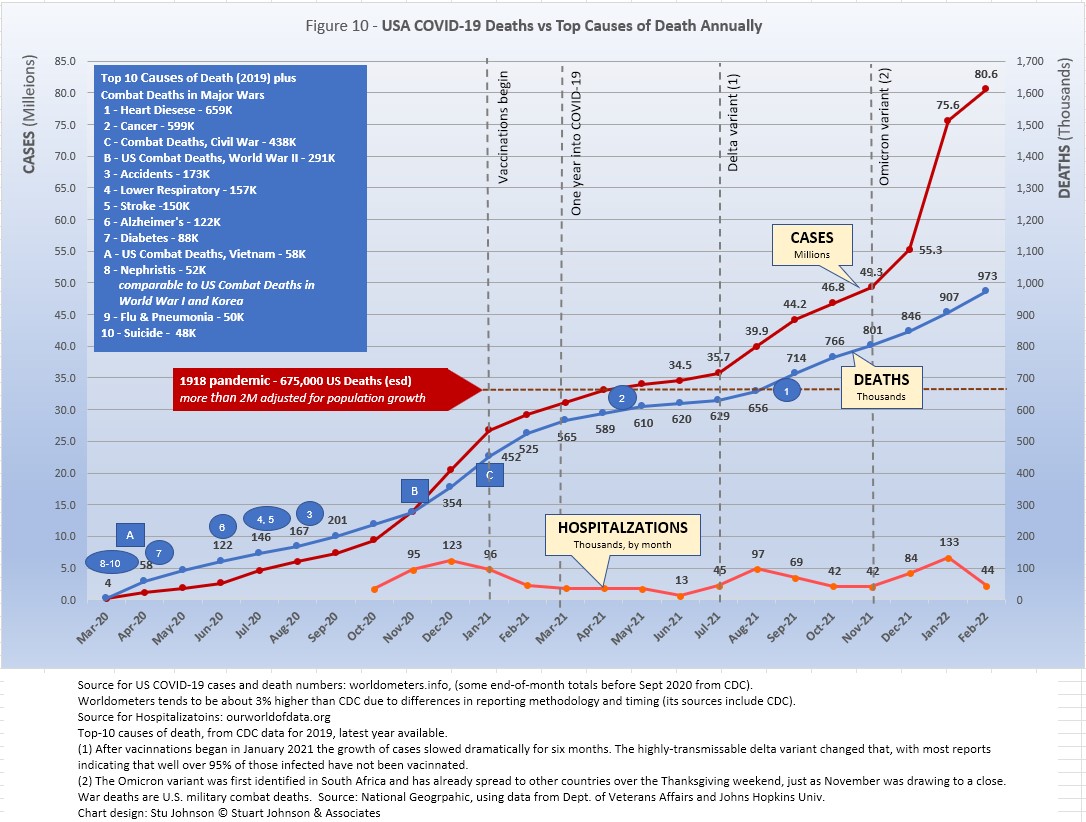

The upward bend for USA cases from August 2021 to January 2022 is clearly visible in Figure 1, but even more pronounced in Figure 10 below, which "zooms in" on USA. Figure 11 provides a detailed view of USA vaccination.

Figure 1 also shows how much lower cases in USA would be—approaching 17-million by now, instead of 81-million—if they were proportional to the global population. It would also mean about 255-thousand deaths instead of approaching 1 million..

USA deaths continues to represent a proportion of world COVID deaths far in excess of its 4% share of world population. (China and India represent roughly one-third of world population between them). USA deaths declined from 20.9% of the world total in September 2020 to 14.5% at the end of August 2021, before inching up each month since then, ending February with deaths at 16.3% of the world total.

- THE OMICRON VARIANT emerged at the end of November 2021 and hit Europe hard, bringing back lockdowns and severe restrictions in several countries. In January the surge became turbo-charged and spread to North America and to a lesser but noticeable extent to South America and Asia. The global omicron surge (still focused largely on Europe and North America) slowed only slightly in February, while in USA it slowed more noticeably. While deaths can follow well behind increases in cases, it appears that both delta and omicron have had minimal impact on the pace of COVID deaths as mortality rates (deaths as a proportion of cases) continue to fall.

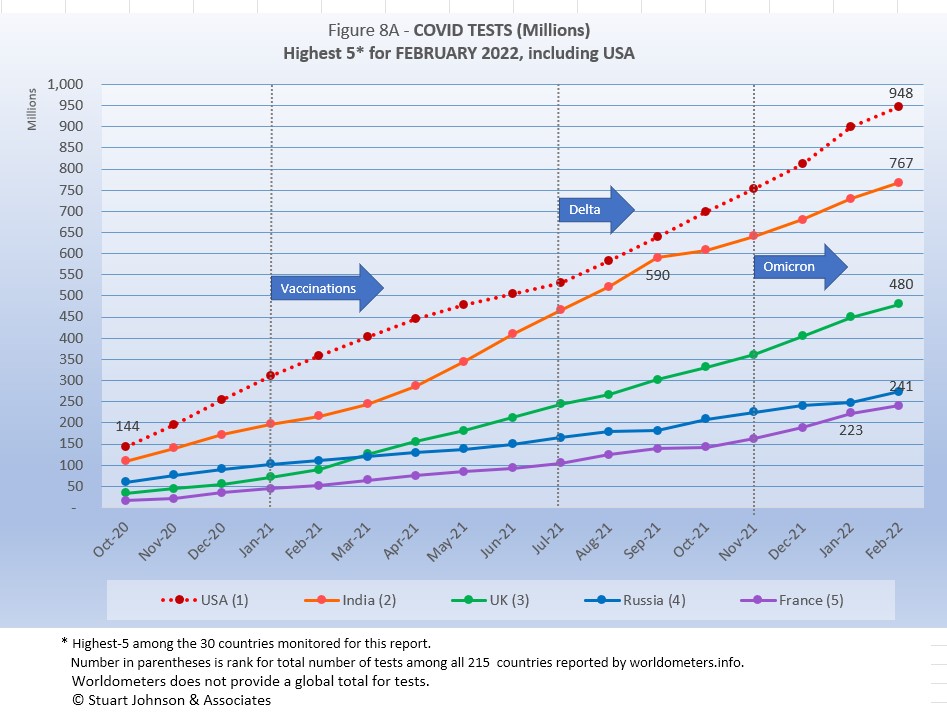

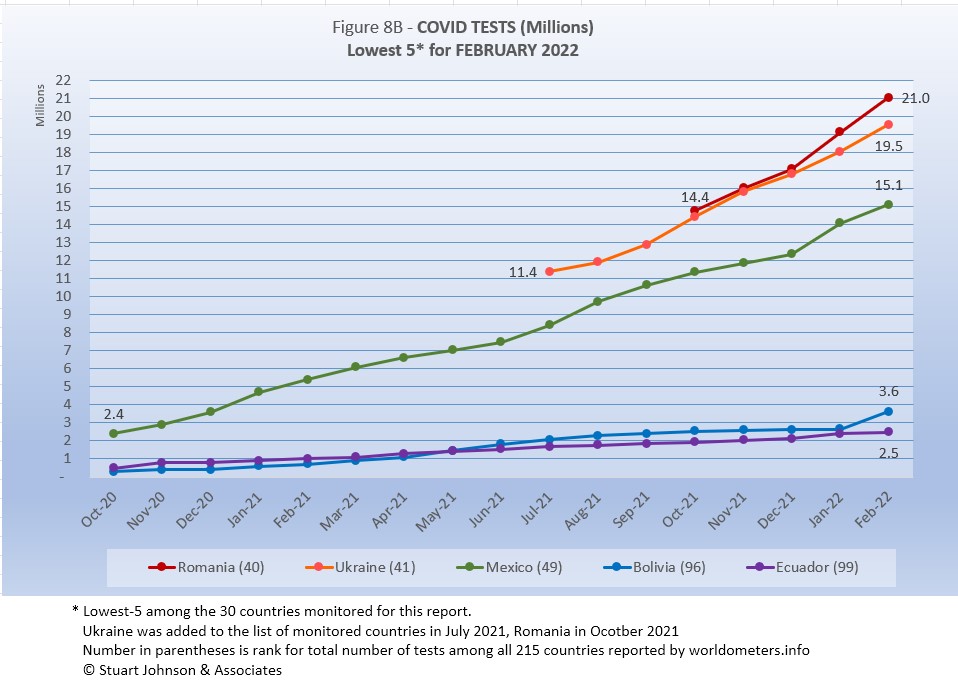

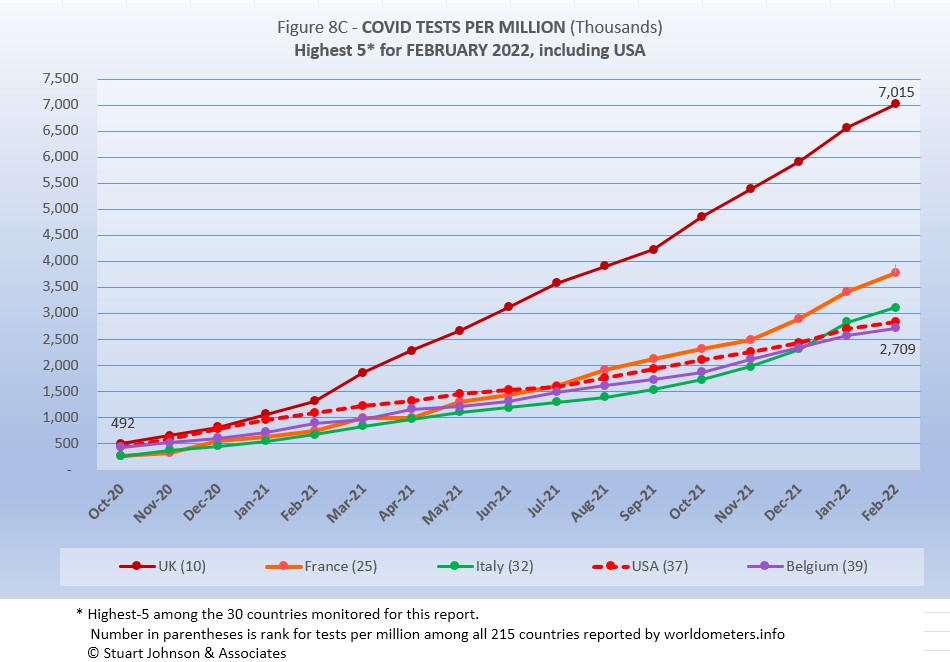

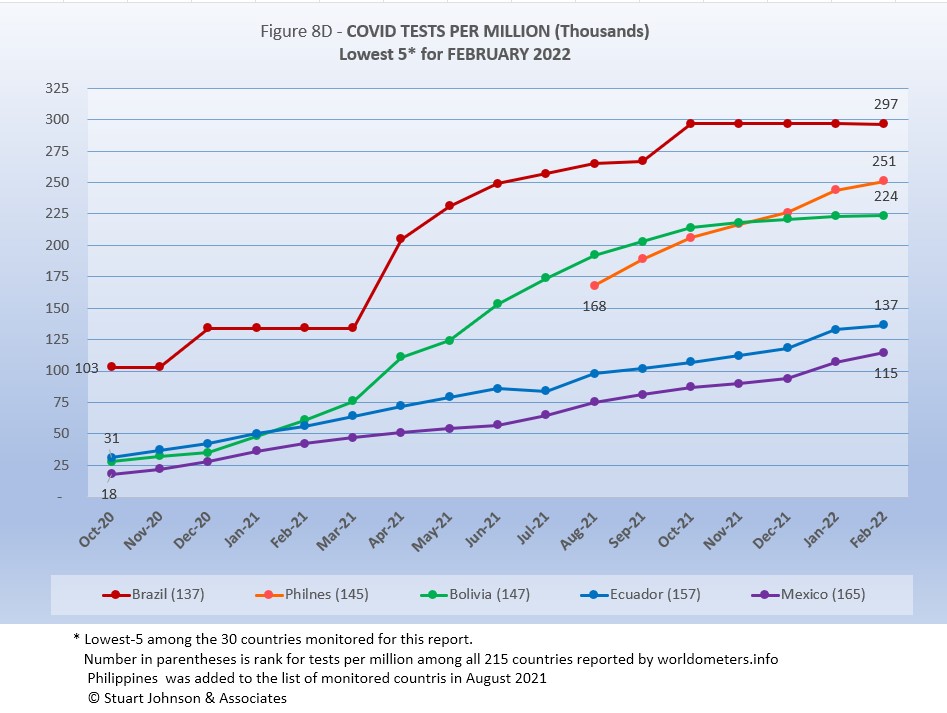

- TESTING. USA leads in the number of tests, with 898-million, followed by India, UK, Russia and France. Of the 30 countries monitored for this report, Romania, Ukraine, Mexico, Bolivia and Ecuador report the lowest number of tests. By proportion of population (tests-per-million), UK remains far ahead of others, with the equivalent of 7 tests per person. USA is about 3 tests per person, similar to the other top countries. At the low end, the number of tests covers 29% or less of population. (See figures 8A, 8B, 8C, and 8D). With home tests available more widely since last month, it will be hard to see their impact on the overall amount of testing, since their use is not reported to health agencies.

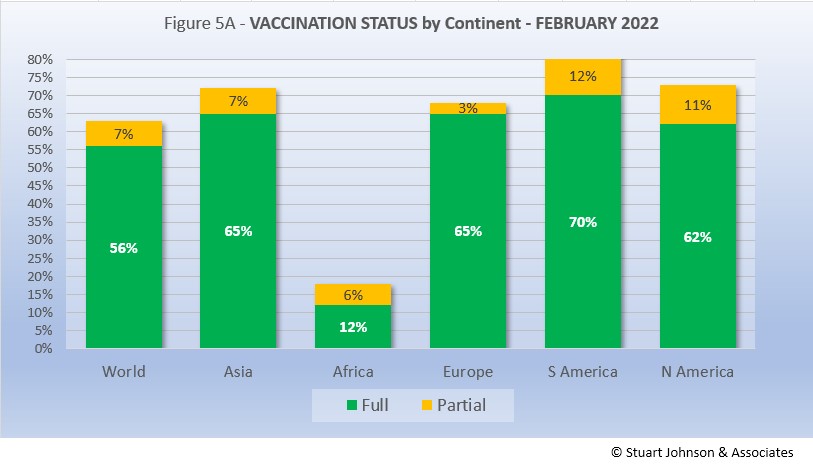

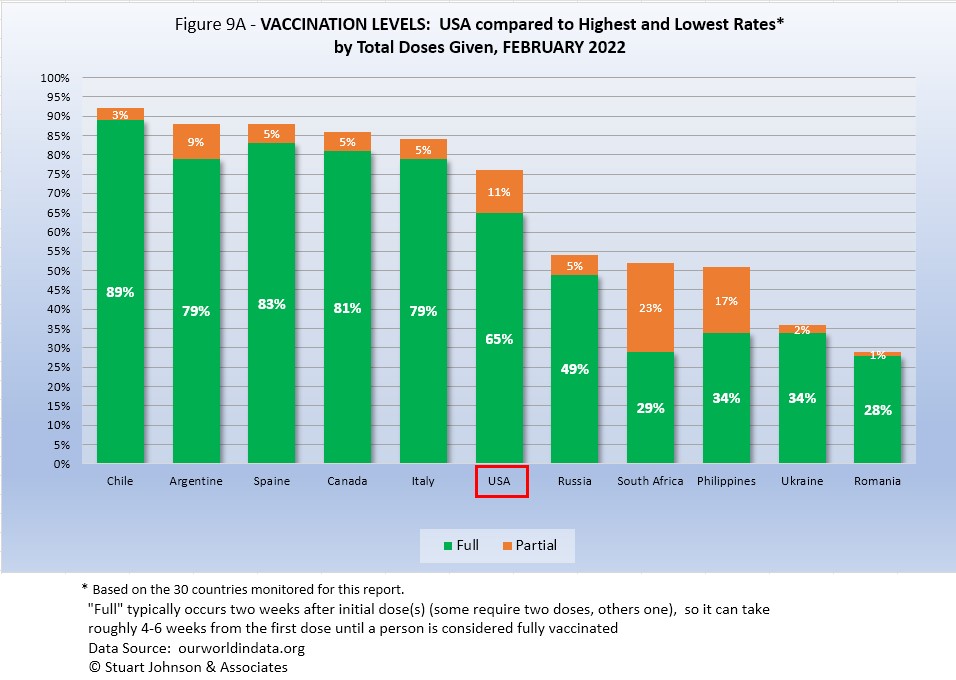

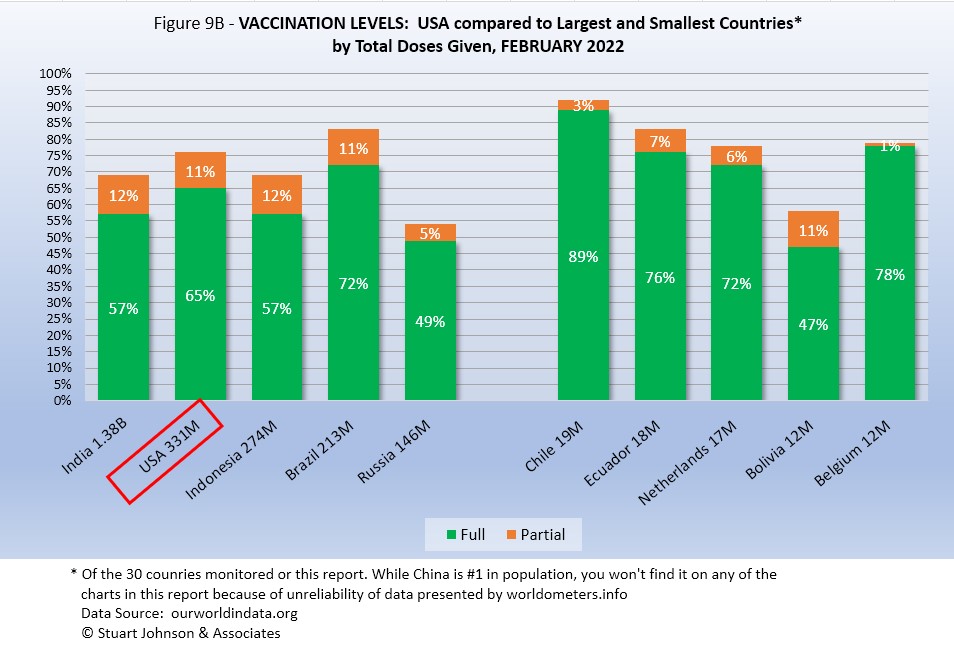

- VACCINATIONS. 63% of the world's population have been reported as receiving at least one dose of vaccine by the end of February. (See figures 5A, 5B, 5C, 9A, 9B and 11).

South America leads the world in vaccination, with Chile reporting 89% fully vaccinated. USA continues to move ahead, but slowly, with 65% fully vaccinated at the end of February and another 11% partially vaccinated.

- COUNTRIES TO WATCH. Japan was added to the list of countries monitored for this report as it appeared in the top-20 for number of cases in February. That brings the number of countries on the list to 30 (see the table at the end of this report for a profile of the monitored countries).

The weekly comparison report on worldometers.info gives a sense of hot spots to watch. Based on weekly activity, this includes South Korea, Vietnam, Hong Kong, Austria, Australia, and Thailand—all in the top 20 of new cases and/or deaths in the last week of February. While some of these have populations too small to make much of an impact on this report, they generally confirm (along with countries recently added to my monitored list) that the recent focus on Europe is broadening out again as omicron spread more widely.

Where you get information on COVID is important. In an atmosphere wary of misinformation, "news-by-anecdote" from otherwise trusted sources can itself be a form of misinformation. As I go through the statistics each month, I am reminded often that the numbers do not always line up with the impressions from the news. With that caveat, let's dig into the numbers for January 2022.

THE CONTINENTAL VIEW

The most obvious trend in February is the continued surge in COVID cases in Europe and North America. Oceana is not included because of its small size, about one-half a percent of world population.

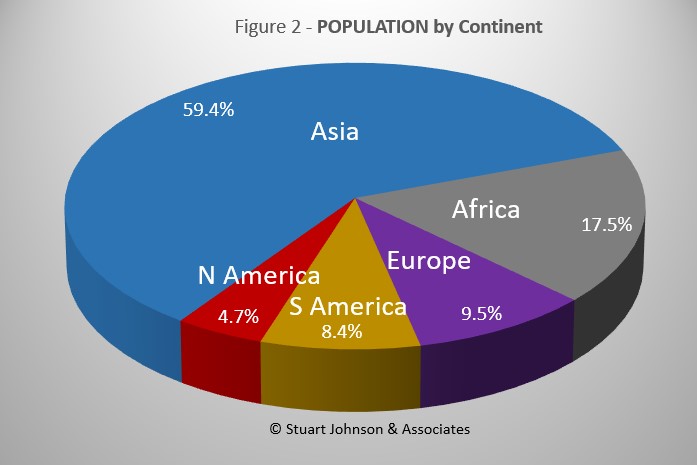

While COVID-19 has been classified as a global pandemic, it is not distributed evenly around the world.

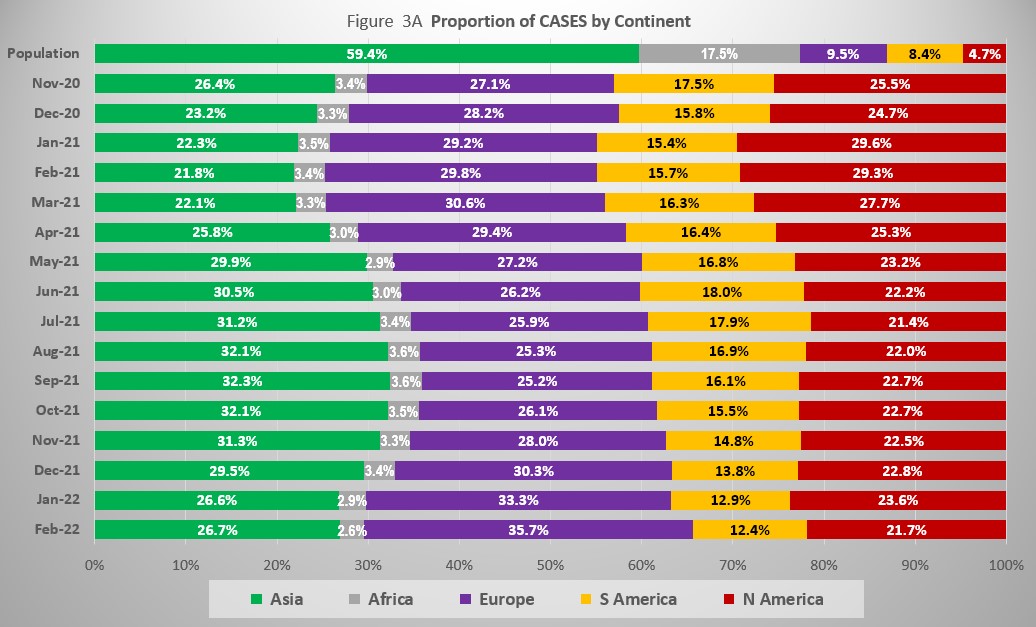

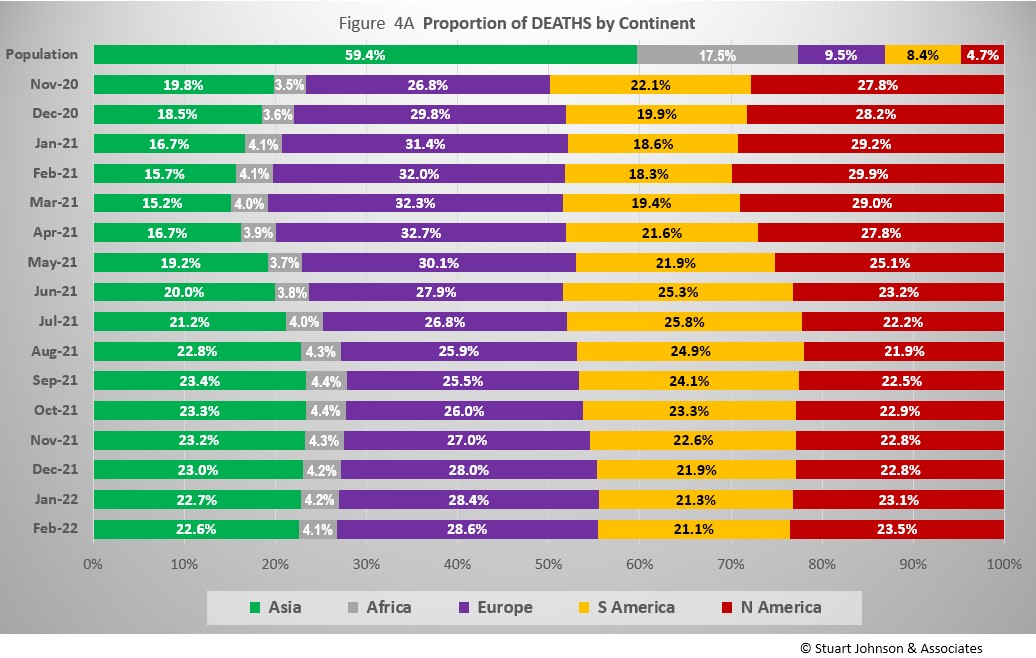

COVID cases now represent 5.4% of world population. (By the end of the 1918 pandemic, it is generally reported to be about one-quarter of the population.) Where Asia and Africa combined represent about three-quarters (76.9%) of the world's 7.9-billion people, Europe, South America and North America still account for 7 in ten COVID cases (70.4% - Figure 3A) and nearly three-quarters of COVID deaths (73.2% - Figure 4A).

The major trend in February was the continued massive surge in Europe due to the omicron variant. After four months at 25 to 26% of world cases, Europe's share kept pushing higher, ending February at 35.7%. Even though omicron produced surges on other continents, the impact was blunted because of Europe: South America continued a decline in proportion of world cases that started in June and North America reversed a noticeable upward bump in January, with February back to 21.7%, a level not seen since June. Asia and Africa combined have been dropping in proportion since September, with a significant shrinkage in January that continued into February.

Overall, Europe is up 8% in COVID cases since the chart begins in November 2020*, while Asia is virtually unchanged and the others down: Africa 1%, North America 4% and South America 5%.

* After months of emphasizing mitigation and :"flattening the curve," which seemed to be working through mid-2020, November of 2020 marked the beginning of a major

worldwide surge that would extend through January 2021 (when vaccines became available). This surge marks the upper edge of my projection cone in Fig, 1.

Omicron left no doubt that it was real and widespread in January and just as strong in February in Europe, Asia and South America. Only North America showed a downturn and Africa remained remarkably detached, despite having the second largest population after Asia .. .

Europe shows the greatest impact in number of cases, nearly doubling, from 87 million in December to 156 million in February. Asia matched Europe in cases in December, but its omicron surge was a bit more restrained, but still went up in a straight line to 116 million. North America shot up dramatically in January, but slowed in February, ending at 95 million. (If it increased at the same pace as January, it would have caught up with Asia. South America, which had flattened considerably in the closing months of 2021, had its own straight line surge in January and February, moving from 40 to 54 millions cases.

The raw numbers of Fig. 3B can be deceptive. Fig. 3C gives a more realistic picture of the impact by translating raw case numbers to percentage of population. The shape of the curves is similar to those for raw numbers, but the order and spacing paints a different picture.

The impact of Omicron in January and February is clearly shown, with the global share of COVID cases increasing from 3.6% to 5.5%. Europe saw the biggest increase, climbing steadily both months, but North America remains on top, even though it slowed significantly in February. South America, which had been practically flat since August, increased steadily both months, but stays much closer to the global level. Asia shows a slight upward bend, while Africa shows virtually no change, both remaining below the global level. .

The proportion of deaths between continents shows less extreme change than that for cases. In fact, given the radical change in cases for Europe in the past three months (Fig. 3A), the continental share of COVID deaths has remained remarkably stable. The changes in Fig. 4A can be divided into three sextons (the pattern is similar in Fig. 3A for cases, but not as clear as it is here):

- November 2020 to March 2021 - Europe and North America expand as Asia and South America contract.

- April to July 2021 - Asia and South America expand as Europe and North America contract

- August 2021 - February 2022 - Europe and North America expand as Asia and South America contract

Overall, Asia is up 3% in proportion of COVID deaths from where the chart starts in November 2020, Europe is up 2%, Africa is up 1%, while South America is down 1% and North America down 4%.

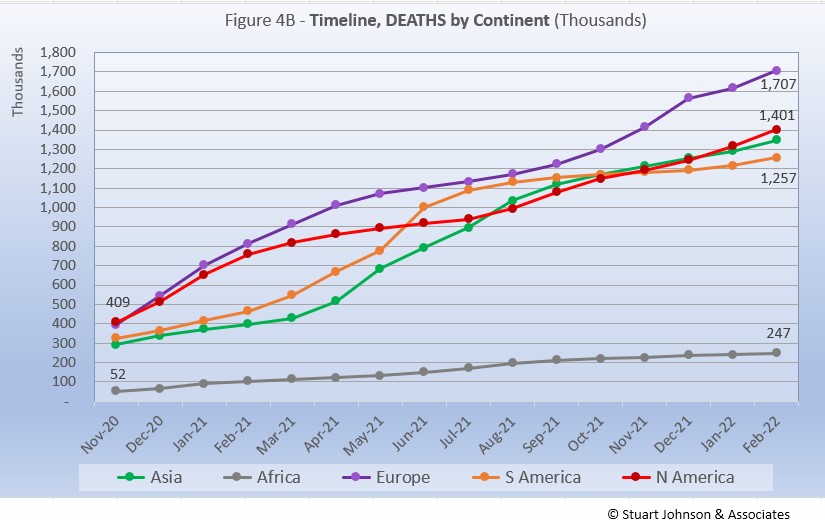

Deaths through February 2022 show that while the trajectory lags behind cases and has progressed at a steadier rate, it does reflect the overall changes in Cases by continent. Except for Africa, which is well below the other continents in the number of COVID deaths, for the other four the 1-million milestone has been in the rear view mirror for months.

While the omicron surge in Europe went "through the roof," what is interesting here is that the death rate actually took a turn downward in January, with a very slight upturn in February. Part of that is explained by the lag between cases and deaths, but the relative steadiness in the path of each curve shows that the death rate has remained much more constant over time than cases and, as we'll see later, mortality rates (deaths as a proportion of cases) continue to fall.

Vaccinations

As Fig. 5A shows, nearly two thirds of the global population (63%) has been reported with at least one dose of vaccine, and more than half (56%) are fully vaccinated. That is still well below what is commonly thought of for "herd immunity," which is closer to 94% of the population being immune (most through vaccination), but is remarkable nonetheless given the enormity of the effort represented in just over a year since vaccines became available.

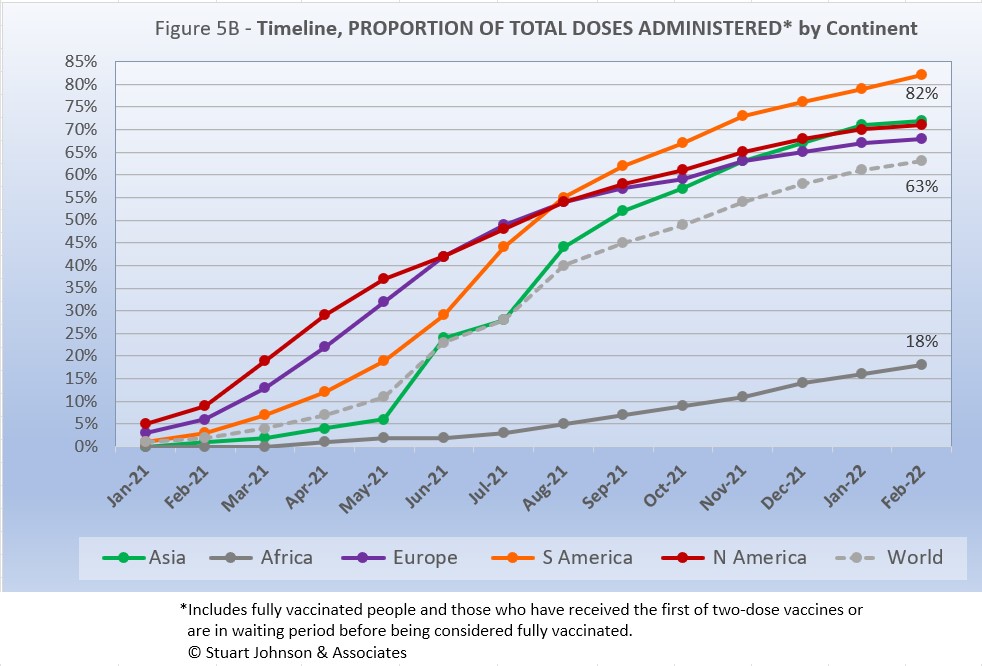

South America, which was slow to get into testing and vaccination, soared ahead of the other continents toward the end of 2020, taking the lead in total vaccine doses in August 2021. While North America is second in overall vaccinations, it is fourth in those who are fully vaccinated. The proportion of partial vaccinations in North America has risen faster than full vaccinations showing that omicron may have provided the incentive for some vaccine resisters to get their first dose.

While South America got into vaccinations later and slower than North America and Europe, Figure 5B shows how it steadily pushed its way to the top of total vaccination doses administered by August 2021, expanding its lead since then—and this by proportion of population, not raw numbers, so it's a fair comparison. Where North America started aggressively, it slowed in June as Europe and Asia caught up, with Asia barely ahead of North America at the end of February (72% vs 71%). Europe ended February at 68% of its population receiving at least one dose of vaccine.

Where South America continues to push upwards toward 90%, Asia, North America and Europe have all slowed, increasing only 1% over January and falling about 10 points behind South America/ Combined with the still very low proportion of African vaccination, the global curve stayed below two-thirds (63%) in February.

COMPARISON OF USA WITH OTHER COUNTRIES

Cases

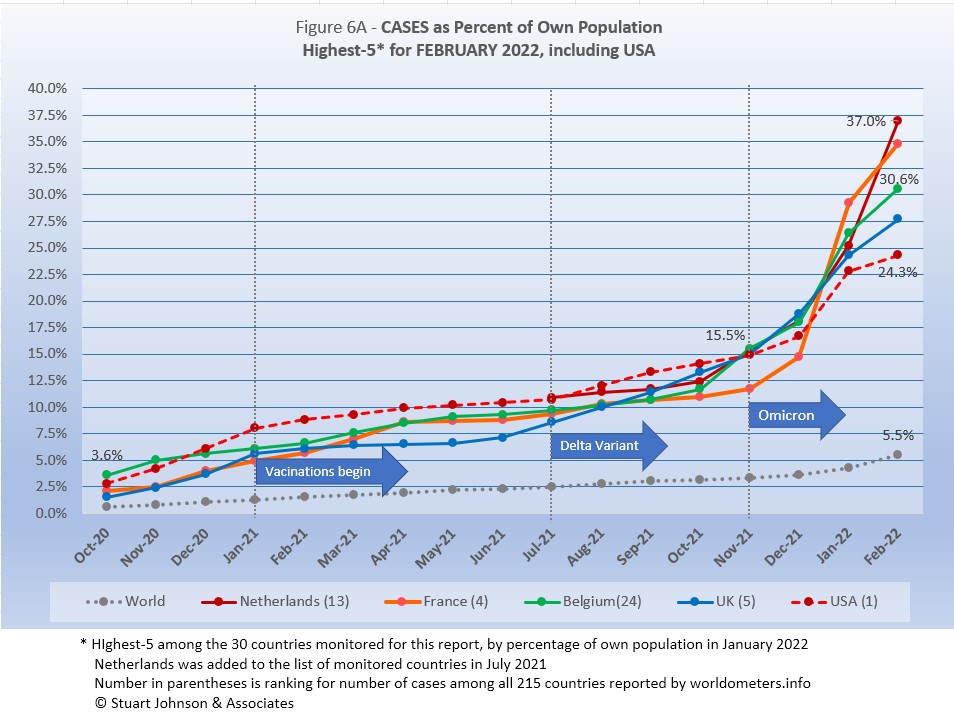

Raw numbers are virtually meaningless without relating them to the size of a given country, so looking at cases as a proportion of population helps get a sense of the relative impact. The countries with the greatest proportion of COVID cases illustrates how they amplify what is barely noticeable in the world trend for cases (bottom line in Figure 6A),

The same five countries have been in the top-5 for four months, only shifting in order. In mid-2021, Brazil, Argentina and Columbia were in the top-five, but since October it has been dominated by Europe and USA.

As we saw in the continental view, omicron left its unmistakable imprint on the rise in proportion of COVID cases. While USA leads in number of cases, it is last in the top-5 by proportion of population, ending February with close to one-quarter of its population having been reported with COVID. Much smaller in geography and population, Netherlands now has seen more than a third of its population (37%) reported with COVID.

Another way to look at population proportion is the measure "1 in." The global figure of 5.5% means that 1 in 18 people in the world have been reported with COVID-19 since it began (and that only by official record keeping, not including any unreported and likely asymptomatic cases). For USA and UK it is 1 in 4; for the other three in the top-5 it is 1 in 3. 19 of the 30 monitored countries are now at a proportion of 10% or more, meaning 1 in 10 or fewer.

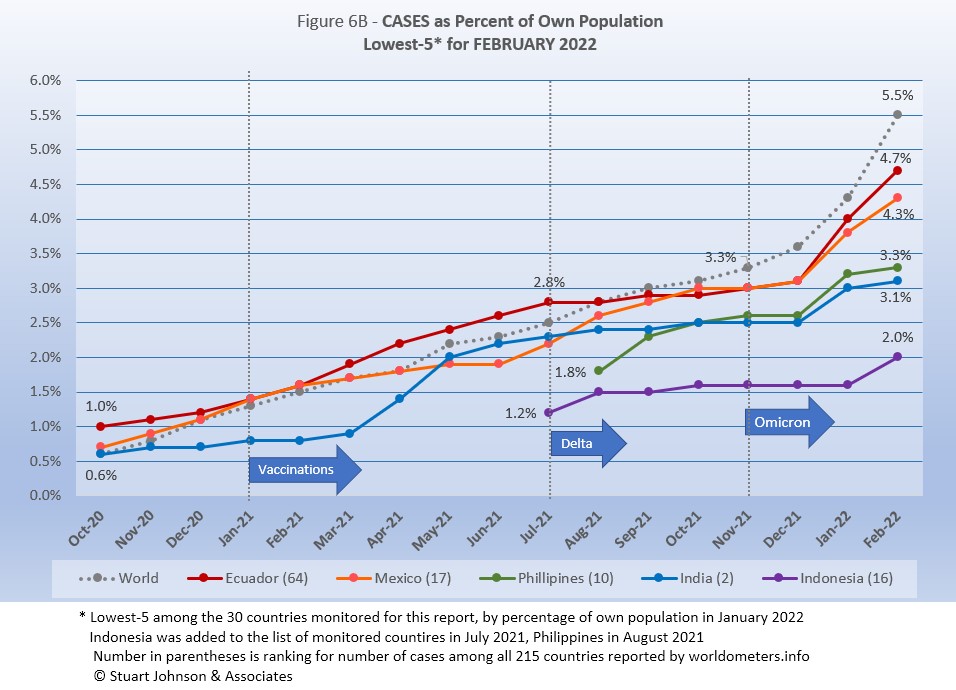

All five countries (of the 30 monitored) in the bottom-5 by proportion of population have been there since September 2021.

At the scale of this chart, the rise in Global case proportion is magnified compared to the previous chart, so it clearly shows the acceleration of cases produced by omicron around the world since November.

These countries represent a considerable spread in size, from India, the second largest country, to Ecuador, ranked number 67 of the 215 countries tracked by worldometers. For Ecuador, its 4.7% of population means that 1 in 21 have been reported as having had the COVID virus; for India it is 1 in 32, and for Indonesia 1 in 49.

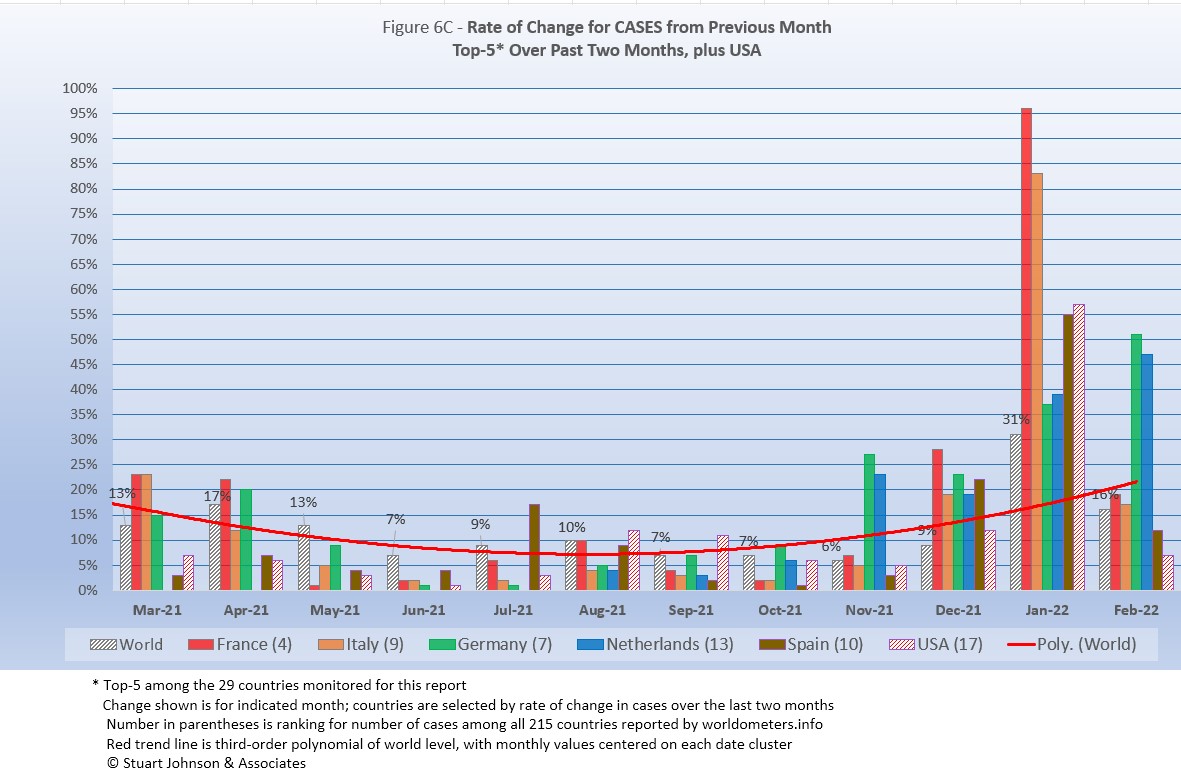

Because the size of countries makes the use of raw case numbers illusory, another measure I find helpful is the rate of change from month to month (Figure 6C). The focus of the selection is on recent changes, but the chart goes back to March 2021, which shows the first major surge fading as vaccinations began.

For this chart, countries are selected based on the change over two-months (end of December to the end of February for this report). For the chart this month Germany and Netherlands replace Belgium and Canada.

The overall trend (red line, reflecting global level) had been falling as the global level reached 6% (of change over the previous month) in November, but omicron pushed it back up to 31% by the end of January before settling back to 16% at the end of February.. (The trend line smooths out more rapid month-to-month changes).

The changes shown for February reflect the downturn in the increase of global cases, with France, Italy and Spain down near the global rate of change after extraordinary spikes in January (remember, inclusion in the chart is based not just on the most recent month, but change in the past two months). Germany and Netherlands, while elevated in January, were even higher in February. USA, 17th of the 30 countries by rate of change over two months, was higher than the Global rate in January, then back down well below it in February, when it experienced an increase of 7% over January.

The chart below shows how the top-5 has shifted since May 2021, from dominance by Asia and South America in mid-2021, to resounding impact of omicron on Europe in the past four months.

| Month | Top-5 for Increase in Cases Over 2 Months | Note | ||||

|---|---|---|---|---|---|---|

| May 2021 | India | Argentina | Turkey | Iran | Columbia | Asia surging |

| June 2021 | India | Argentina | Colombia | Bolivia | Chile | South America surging |

| July 2021 | Colombia | Iran | Argentina | UK | Bolivia | Delta appears |

| August 2021 | Iran | UK | Mexico | Turkey | Russia | Delta rising |

| September 2021 | Iran | UK | Mexico | Turkey | USA | Delta fading |

| October 2021 | Philippines | UK | Ukraine | Turkey | Russia | Mixed |

| November 2021 | Belgium | Ukraine | Germany | UK | Netherlands | Omicron appears |

| December 2021 | Germany | Belgium | Netherlands | UK | France | Omicron intensifies |

| January 2022 | France | Italy | Spain | Belgium | Canada | Omicron intensifies |

| February 2022 | France | Italy | Germany | Netherlands | Spain | Omicron intensifies |

| Color Legend: Continent assignment as defined by United Nations and used by worldometers.info | ||||||

| Asia | Africa | Europe | S America | N America | ||

Deaths

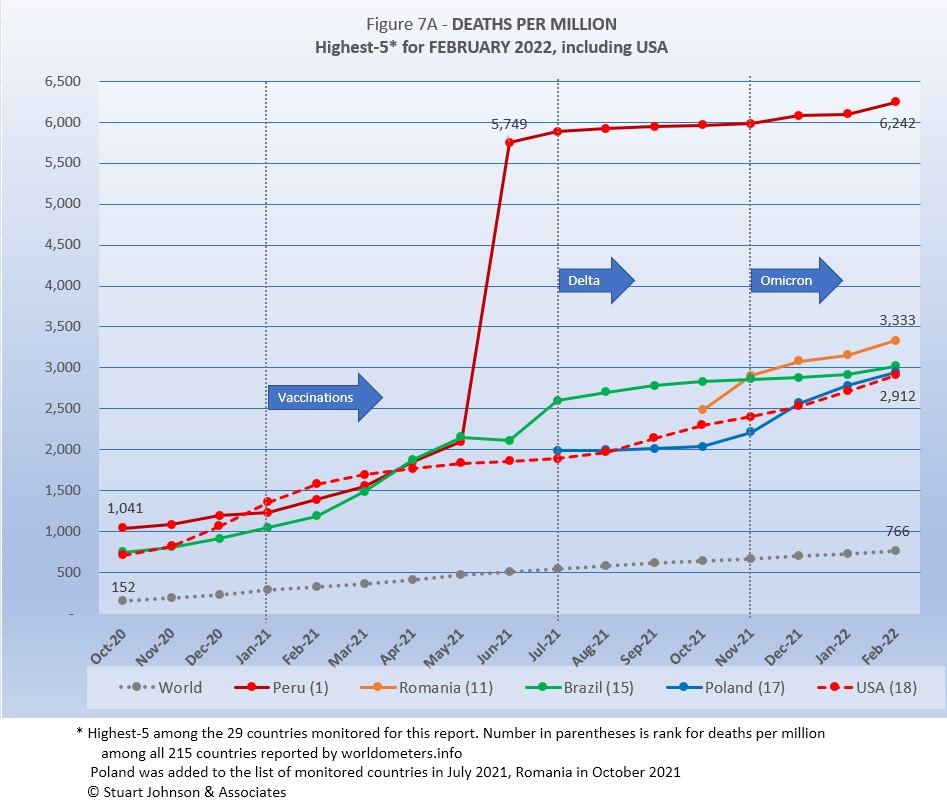

Because deaths as a percentage of population is such a small number, the "Deaths-per-Million" metric shown in Figure 7A provides a comparable measure.

The same five countries return to this month's top-5.

The Global curve for deaths-per-million shows a very steady growth, despite surges, vaccinations and variants that had a much more obvious influence on cases.

As Figure 7A shows, Peru still soars over the others following a correction to its death data in June 2021. It shows a slight increase in the head rate with omicron in January and February 2022, remaining about double the remaining four, which all rose faster than the Global rate.

While USA tracks with its three neighbors in the top-5 for January and February, when omicron was mot evident, it's overall curve is much smoother, with a steeper rise through the surge of November 20 through February 2021, with a leveling off during the first months of vaccination, followed by a steady upturn starting with the delta variant in August 2021.

All of the countries on the chart are well above the Global level, and (except for Peru) remain fairly close to each other.

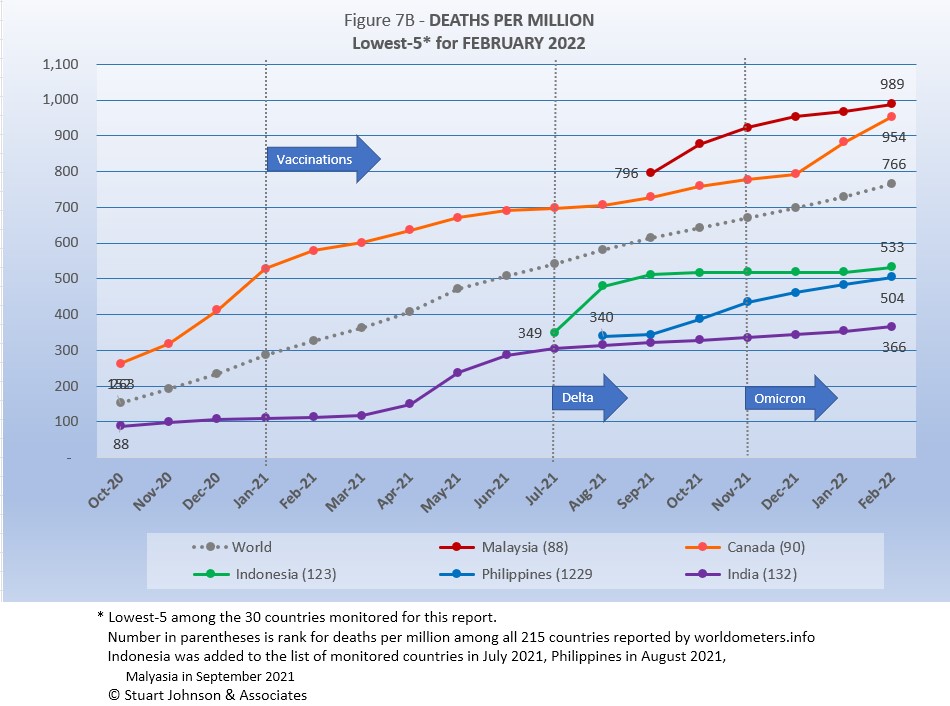

All five countries have been in the bottom-five of deaths-per-million for the last three months. Malaysia replaced Turkey in December and Netherlands appeared for one month back in August, before being replaced by Philippines.

.Showing the most obvious impact from omicron is Canada, which had been flattening out, headed toward falling below the Global rate, but January and February saw it accelerate significantly. The others remained steady or showed only a slight increase during the omicron surge.

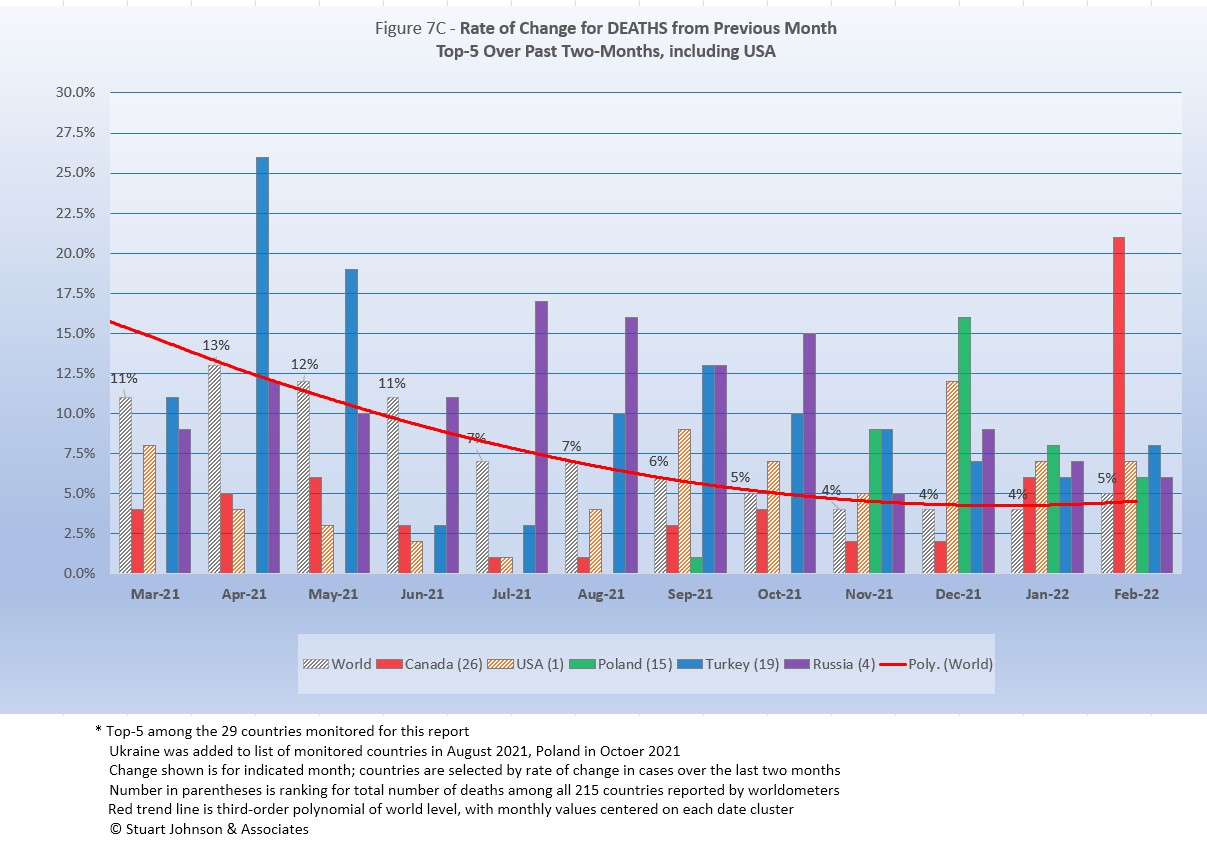

As with the comparable chart for Rate of Change for Cases (Figure 6C), countries for Rate of Change for Deaths (Figure 7C) are selected based on the change over two-months (end of December to end of February) in reported COVID deaths. The focus of the selection is on recent changes, but the chart goes back to March 2021 for perspective.

Canada and USA replaced Ukraine and Germany in this month's report. The chart below shows the changes in the top-5 countries over past months.

Unlike Figure 6C for Rate of Change for Cases, which dipped then rose again at the end because of omicron, the global trend (red line) for Rate of Change for Deaths continued on a downward path, with a very slight increase in February suggesting omicron.

Overall, you can see that Turkey and Russia had much greater increases in past months than the top-five combined for January and February. Poland then spikes in November and December. The largest spike in January and February is Canada with deaths increasing by 21% in February. USA increased 7% each month, enough to put it in the top-5 by change over two months.

Contrast this chart with the one for cases above. In this chart, focused on increases in deaths, South American countries dominates early, then shifts to a mic of Asia, Europe and North American countries. In the chart focused on cases, the early months are mixed and then western European countries dominate in recent months. This contrast supports the idea presented throughout this report that surges in cases do not bear a high correlation with increases in death. In fact, comping the European countries, increasing cases have been dominated by those in west Europe, while increasing death rates have been more often been associated with eastern European and Asian countries (one possible factor being a slower start on vaccine availability and distribution).

| Month | Top-5 for Increase in Deaths Over 2 Months | Note | ||||

|---|---|---|---|---|---|---|

| May 2021 | India | Turkey | Brazil | Colombia | Argentina | Tilt toward S America |

| June 2021 | Peru | India | Argentina | Colombia | Bolivia | South America surging |

| July 2021 | Peru | Ecuador | Colombia | Argentina | Russia | South America surging |

| August 2021 | Ecuador | Russia | Iran | Argentina | Colombia | South America fading |

| September 2021 | Indonesia | Iran | Russia | Turkey | Malaysia | Asia surging |

| October 2021 | Philippines | Russia | Ukraine | Turkey | Iran | Asia surging |

| November 2021 | Ukraine | Russia | Philippines | Turkey | Malaysia | Omicron beginning |

| December 2021 | Ukraine | Russia | Poland | Romania | Philippines | Omicron growing |

| January 2022 | Poland | Russia | Ukraine | Germany | Turkey | Omicron surging |

| February 2022 | Canada | USA | Poland | Turkey | Russia | Omicron surging |

| Color Legend: Continent assignment as defined by United Nations and used by worldometers.info | ||||||

| Asia | Africa | Europe | S America | N America | ||

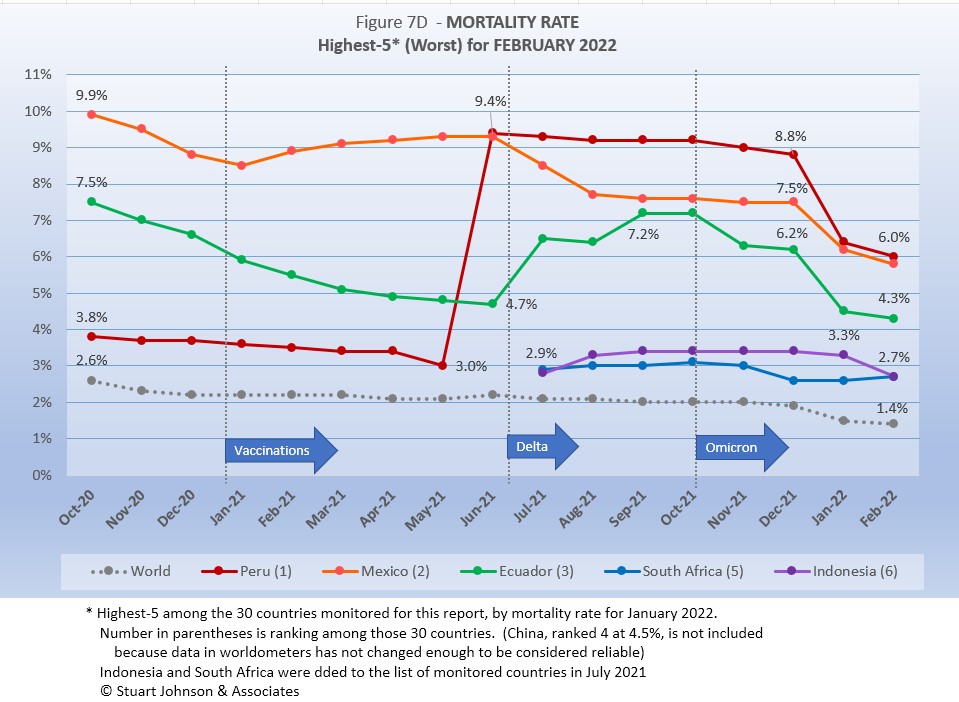

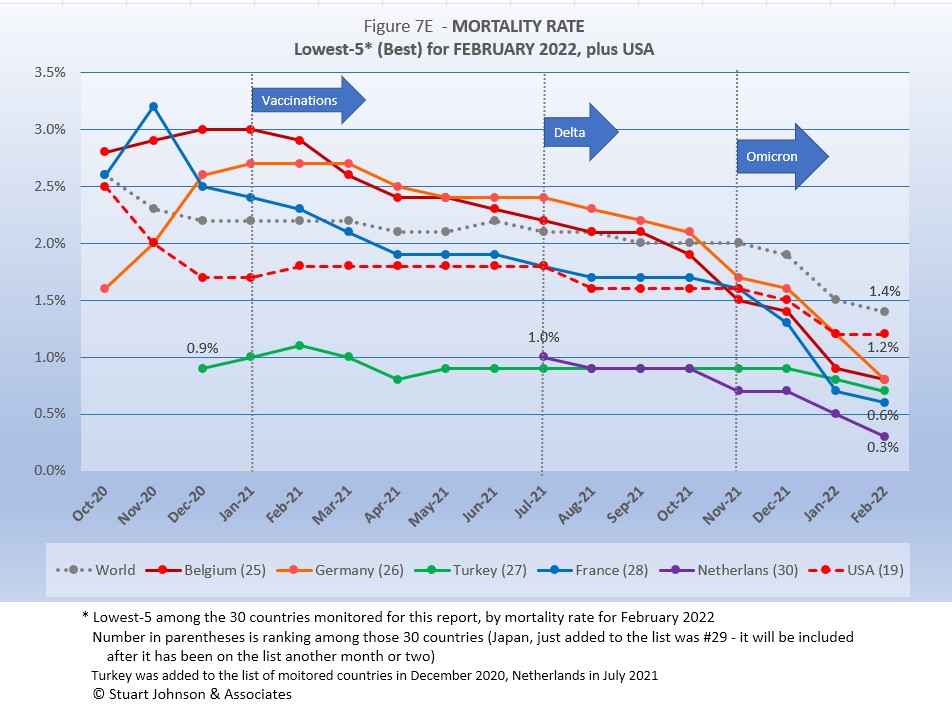

Mortality Rate

Mortality Rates (percentage of deaths against reported cases) have generally been slowly declining. This is not surprising as several factors came into play:

- In the early days of the pandemic, there was a high proportion of "outbreak" cases (nursing homes, retirement communities, other settings with a concentration of more vulnerable people). As the pandemic continued the ratio of "community spread" (with lower death rates) to "outbreaks" increased and the overall Mortality Rate went down.

- As knowledge about treatment increased, mortality went down.

- Since the death count is more certain (though not without inaccuracies), the side of the equation that can change the most is cases. As testing revealed more cases, the Mortality Rate would naturally go down because it would only affect cases and not deaths. In addition, the official numbers do not take into account a potentially higher number of people with the virus who are unreported and asymptomatic, so the real mortality rate could be even lower. (This will be a factor with availability now of home testing, where positives may escape official reporting).

- Vaccinations started in January 2021 and available in January 2022 was the first anti-viral drug (though these should impact both cases and deaths).

- So far, the omicron variant has produced a huge spike in cases, but not in deaths (any increase could take another month or more), which is the reason the global mortality rate dropped so significantly in January 2022.

The Global mortality rate had dropped from 2.6% in October 2020 to 2.0% by September 2021, where it stayed for three months. Interestingly—and proving the point about death rates remaining steady and actually slowing down even as cases surge—the Global mortality rate dropped to 1.4% by the end of February, a mirror image of the upward slope of the curve for cases.

South Africa replaces Russia this month in the 5 worst countries by mortality rate. Because of a correction in its data in June 2021, Peru saw a major spike in its mortality rate, which slowly went down through December, followed by the highest decline in mortality among the five as the same time omicron was riding up case numbers. Of the five countries, only South Africa showed a very slight increase in January and February.

Since these represent the best mortality rates, where low is good, the "rank" order is actually in reverse.

Germany replace UK in this report. Dominated by Europe, all five countries have been seen falling mortality rates, all below the Global rate since November. Only USA (ranked 19 of the 30 countries monitored) saw its mortality rate level off after falling to 1.2% by January.

How real is the threat of death from COVID? That's where successful mitigation comes in. Worldwide, by the end of February, 1 in 18 people have been reported as having contracted COVID and 1 in 1,324 people have died. In USA, while the mortality rate is low, because the number of cases is so high, 1 in 340 have died through February 2022—between Poland (also 1 in 340) and Argentina (1 in 363). India has the lowest impact from death, with 1 death for every 2,606 people. Peru is the worst, at 1 in 157.

With low mortality, USA should have been able to keep deaths much lower, but the extraordinarily high number of cases means more deaths. Even so, without a better-than-global mortality rate, the USA death rate would be far higher. Compared to the mortality rate during the 1918 pandemic, it could be ten times worse than it is. Even at the Global mortality rate of 1.4%, USA would have had just over 1.1-million deaths (out of 80.5-million cases) by the end of February, instead of nearly 975-thousand with a mortality rate of 1.2%. As pointed out in Figure 1, however, if USA had cases closer to its proportion of world population, we would be looking at 255-thousand deaths out of 17-million cases. The response of the health care system and availability of vaccines are part of keeping mortality down.

Tests

The same five countries remain on top in COVID testings, having been in the same order since March 2021.

USA remains ahead of other countries in reported COVID tests administered, at 948-million, 24% ahead of India, widening the gap since September, but well below the 56% gap in April. UK continues at the pace it set in February 2021 (causing it to move into third place back in March 2021). Russia and France remain on paths of slower growth in raw numbers. Last month, I suggested that France could surpass Russia if they continued on the paths seen in January, but Russian moved ahead enough to remain slightly ahead of France.

Since these are raw numbers, it is important to recognize the size of the country. It is also the case that COVID tests can be administered multiple times to the same person, so it cannot be assumed that USA has tested almost all of its population of some 331-million. Some schools and organizations with in-person gatherings are testing as frequently as once a week or more for those who are not yet fully vaccinated. That's a lot of testing!

Another wrinkle in the statistics for tests will be the increasing availability of home tests, where we may able to track sales but not tests administered since they are not like PCR and rapid tests offered by agencies that report testing to health authorities. While the statistics for tests have a degree of ambiguity, they are useful in showing the problem of equity, which is evident in the next chart.

The same five countries return in the same order they have been in for four months. Prior to that, other countries that have been in the lowest-5 have been Peru, Argentina, Belgium, South Africa and Netherlands. .

Romania, Ukraine and Mexico all show upward movement in tests while Bolivia and Ecuador remain at the bottom, though Bolivia showed a promising upward bend.

As questions arise about equity of testing between countries, check the number of tests for countries of similar size (within the 29 monitored countries):

- Mexico: 15.1M tests for 128.9M population, compared to Japan: 38.8M tests for 126.5M population (2.6X the tests)

- Ukraine: 19.5M tests for 43.7M population, compared to Argentina: 34.2M tests for 45.7M population (1.8X)

- Peru: 27.3M tests for 33.0M population, compared to Malaysia: 44.6M tests for 49.4M population (1.8X)

- Ecuador: 2.5M tests for 17.6M population, compared to Netherlands: 21.1M tests for 17.1M population (8.4X)

- Bolivia: 2.7M tests for 11.7M population, compared to Belgium: 31.80M tests for 11.6M population (11.7X)

Tests per million adds another perspective. Fig. 8C shows the five countries with the highest tests per million. All five were in the same order from July through December 2021, then Italy moved to #3 in January 2022, passing USA and Belgium.

UK, already the most aggressive in testing, increased its numerical lead each month since February 2021, with a just over 7-million tests-per-million population in February, representing roughly 7 tests per person. France maintained its #2 position, ending at 3.8-million tests-per-million, nearly four tests per person. USA, at 2.8-million tests-per-million is just ahead of Belgium at 2.7-million.

Anything over 1,000 (or "x-million tests-per-million") represents more tests than people (1,000 on the chart actually means 1,000,000), but as mentioned above, that does not mean that everyone had been tested. Some people have been tested more than once, and some are being tested regularly or with increased frequency.

Brazil replaces Indonesia, though it should probably not be in the lowest-5 since it appears its reporting on tests has been stuck at 63.8-million since October (tests-per-million is then calculated from tests versus population).

Ecuador and Mexico have coasted along at roughly the same slow pace, well below the other three.

While some improvement is seen, the equivalent proportion of tests to population remains very low, from roughly 11% for Mexico to 30% for Brazil (and that would be reduced if some individuals receive more than one test). This illustrates the arguments over inequity in resources among countries.

Vaccinations

Figure 9A compares USA with the top-5 and bottom-5 of monitored countries by total doses administered. As you can see USA leans toward the upper countries, but its total vaccination rate of 76% increased only 1% over January, so it remains below the full vaccination rate for all of the top-5. On the other hand, USA is well ahead of the bottom five of the 30 monitored countries for either total doses or fully vaccinated.

As pointed out in other parts of this analysis, Figure 9A does not tell the whole story. It's a bit of an apples and oranges comparison, with one major factor being the population of each country.

Taking population into account paints a different picture for USA compared to other monitored countries. In Figure 9B you see the five most populous countries on the left and the five smallest (of those monitored for this report) on the right. (China is not included because of unreliability of its data).

Brazil is ahead of USA in both full and total vaccinations. USA is ahead of India, Indonesia, and Russia for both total doses and full vaccination. .

On the side of smallest countries, all except Bolivia are ahead of all five of the biggest countries in fully vaccinated. Chile is far ahead of all ten in total and fully vaccinated.

Thus, individual regions, provinces or states of the largest countries may be doing as well as some smaller countries, while the entire country lags behind the smaller ones.

CAUSES OF DEATH IN USA

Early in the reporting on COVID, as the death rate climbed in USA, a great deal of attention was given to benchmarks, most notably as it approached 58,000, matching the number of American military deaths in the Vietnam War. At that time, I wrote the first article in this series, "About Those Numbers," looking at ways of viewing the data, which at the time of that writing in May 2020 was still focused on worst-case models and familiar benchmarks, like Vietnam.

Three Critical Curves

Figure 10 shows the number of USA COVID cases and deaths against the top-10 causes of death as reported by CDC. That data reflects 2019 figures, the latest year available. More recently, I added a curve for hospitalizations, with data going back to October 2020.

Notice that for nearly nine months, the curve for deaths was increasing at a faster rate than cases. Then, starting in October 2020 the curve for cases took a decided turn upward, while deaths increased at a more moderate pace (the two curves use different scales, but reflect the relative rate of growth between them).

Unlike the case and death curves, which are cumulative, hospitalizations reflects the number of cases requiring hospitalization each month. You can see three peaks: the first with the initial surge (before vaccines became available) in December 2020, followed by August 2021 (delta) and January 2022 (omicron), which now represents the peak of hospitalizations. Notice, however, that the relative spread of cases-to-hospitalization is enormously different for omicron. In December of 2020, there were roughly 6.5-million new cases where January 2022 saw 20.3-million (a 212% increase), yet hospitalizations were only 11-thousand higher (8%).

Benchmarking the Numbers

Media reporting tended to focus on easily grasped benchmarks—deaths in Vietnam or World War II, or major

milestones like 500,000 (crossed in February 2021).

In August 2021 we passed the 2018 level for #1 heart disease (655-thousand), then passed it again in September when the 2019 data "moved the goal post" to 659-thousand. Another significant benchmark, pointed out in some news reports, was the 675-thousand estimate for deaths in USA during the 1918 pandemic. Adjusted for population growth, however, that number would now be around 2-mllion.

Having passed the annual death benchmarks and 1918 deaths, now we can only watch as the numbers continue to climb . . . .

The latest "Ensemble Forecast" from CDC suggests that by our next report we should see:

..he number of newly reported COVID-19 deaths will likely decrease over the next 4 weeks, with 3,800 to 9,100 new deaths likely reported in the week ending March 26, 2022. The national ensemble predicts that a total of 971,000 to 986,000 COVID-19 deaths will be reported by this date..

Note: As I've referenced in the notes for several charts that data from worldometers.info tends to be ahead of CDC and Johns Hopkins by about 3%, because of reporting methodology and timing. I use it as a primary source because its main table is very easy to sort and provides the relevant data for these reports. Such differences are also found in the vaccine data from ourworldindata. Over time, however, trends track with reasonable consistency between sources.

Perspective

The 1918-19 Spanish Flu pandemic is estimated to have struck 500 million people, 26.3% of the world population of 1.9-billion at that time. By contrast, we're now at 3.1% of the global population. Deaths a century ago have been widely estimated at between 50- and 100-million worldwide, putting the global mortality rate somewhere between 10 and 20-percent. It has been estimated that 675,000 died in the U.S.

IF COVID-19 hit at the same rate as 1918, we would see about 2-billion cases worldwide by the time COVID-19 is over, with the global population now at 7.9-billion—four times what it was in 1918. There would be 200- to 400-million deaths. The U.S. is estimated to have had 27-million cases (one-quarter of the population of 108-million) and 675,000 deaths. Today, with a population of 331-million (a three-fold increase from 1918) this would mean more than 80-million cases, and 2- to 4-million deaths.

However, at the present rate of confirmed cases and mortality while the total number of global cases could approach 500 million or more—comparable to 1918 in number—that would be one-quarter of 1918 when taking population growth into account . .. and assuming the pandemic persists as long as the Spanish Flu, which went on in three waves over a two year period. (We are facing entering a third year in March 2022). At the present rate of increase (close to 21.8-million cases per month) it would only take another 3 months to reach 500-million, roughly May of this year. That rate has accelerated as delta and omicron surges raised the case total significantly. The projected time to reach 500-million shrank another four months since my last report. Since omicron appears to have peaked, however, that rate could slow down, but we don't know what other variant may come along before COVID turns from pandemic to endemic.

If the total number of cases globally did approach 500-million, using the global mortality rate of 1.4% in February, there would be roughly 7.0-million deaths worldwide. Tragic but far below the number reported for 1918 (50-million) with an even wider gap (200 million) when taking population growth into account.

Earlier in the summer of 2021, I indicated that with vaccinations in progress and expected to be completed in the U.S. by the end of summer, the end of COVID-19 could come sooner. Like 1918, however, there have been major complicating factors, such as the combination of the delta and omicron variants with a high number of unvaccinated (ironically hitting hardest in Europe and USA where vaccines are readily available). While we may have thought the end of the pandemic was in sight, it is still too early to make predictions on the duration and severity of the COVID-19 pandemic globally. Indeed, when I commented on the curve for cumulative cases in December, said it looks like the trajectory of an airplane climbing toward cruising altitude. In January and February, however, it looks more like a rocket headed toward orbit!

Despite the darkening forecast since delta and omicron, the vast difference in scale between the Spanish Flu pandemic a century ago and COVID-19 cannot be denied. Cases may be soaring but are behind 1918 when adjusted for population growth, and either way deaths are far below 1918 mortality. The key differences are the mitigation efforts, treatments available today (though still leaving the health care system overwhelmed in some areas during surges), the availability of vaccines and the first anti-viral drug for those recently infected.

In addition, in 1918 much of the world was focused on a brutal war among nations (World War I) rather than waging a war against the pandemic, which ran its course and was undoubtedly made much worse by the war, with trans-national troop movements, the close quarters of trench warfare, and large public gatherings supporting or protesting the war. While you will see pictures of police and others wearing masks during the 1918-19 pandemic, the need to promote the war effort and maintain morale took precedence over the kind of mitigation associated with major virus outbreaks since then, including COVID-19. Another factor clearly shown in the charts in these reports has been that the rate of increase in deaths has for some time now been well below the increase in cases, especially since vaccines became available in January 2021.

VACCINATIONS IN USA

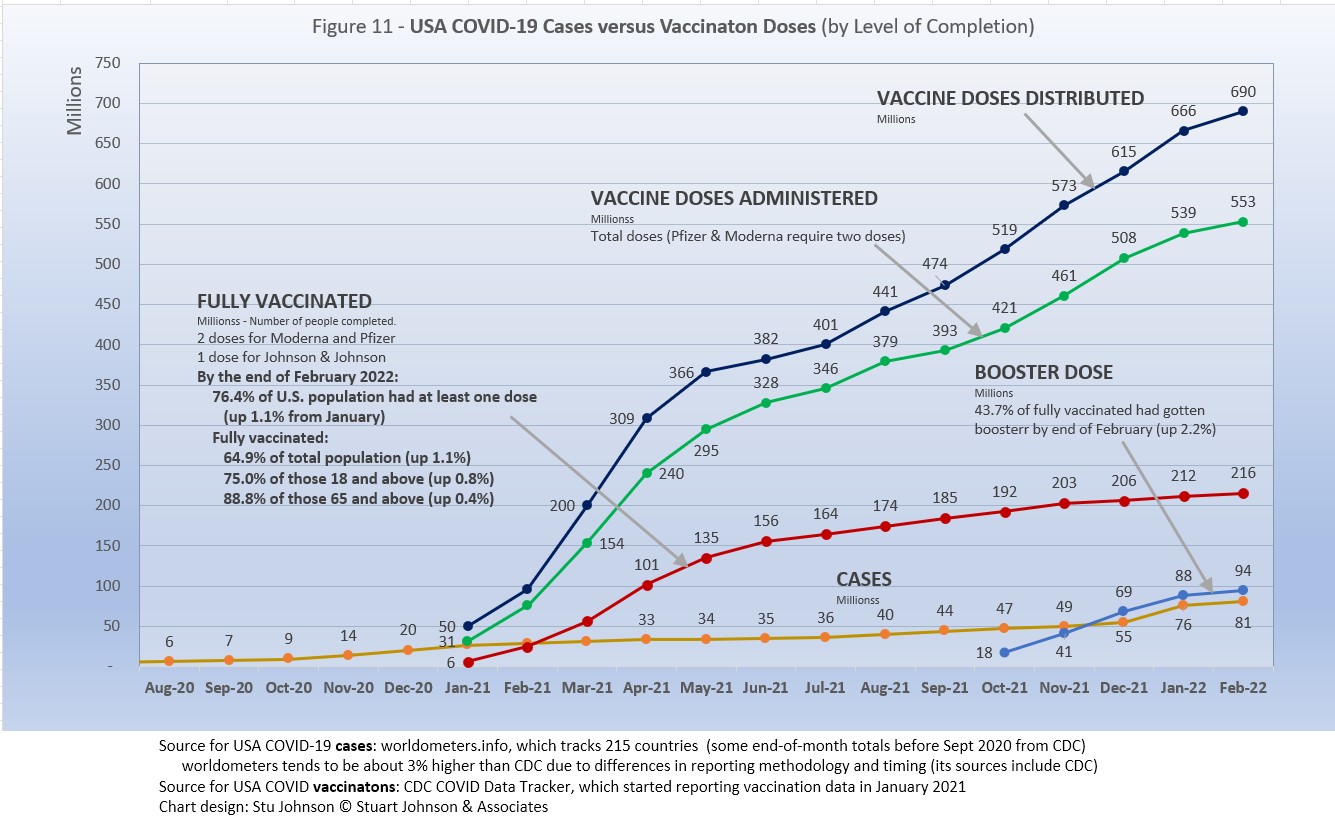

With remarkable speed (it usually takes years to develop vaccines), two COVID vaccines were granted emergency approval for use in USA starting in January 2021—the one by Pfizer requires super-cold storage, which limits its deployment. The other, by Moderna, requires cold storage similar to other vaccines. Both of these require two doses, which means that vaccine dosages available must be divided in two to determine the number of people covered. By March 2021 Johnson & Johnson had been granted approval for a single-dose vaccine. The numbers in Figure 11 represent the status of all three vaccines as of December 31 (as reported by CDC, which will be slightly different than ourworldindata data used in earlier vaccination charts). .

A person is considered "fully vaccinated" two weeks after the final (or only) vaccine dose; roughly five to six weeks total for Pfizer and Moderna and two weeks for Johnson & Johnson.

After a rapid start, vaccination slowed in late spring. Figure 11shows an upturn in Doses Distributed and Administered in August, a sign that perhaps the delta variant provided the impetus for increased vaccinations. The rate of increased distribution has continued into January. Doses Administered dipped slightly in September then recovered in October through November, then dipped again in January. The curve for Fully Vaccinated has increased fairly steady, but at a far lower rate than doses administered, meaning we're not closing the gap between partial and full vaccination (which increased just over 1% in February).

Those getting boosters is up to nearly 94-million in four months, four in ten (43%) of those who are already fully vaccinated, but the curve bent down in February. In addition, in early November the CDC expanded vaccination approval for children ages 5-12 and in December the FDA approved the first anti-viral drug, Pfizer's Paxlovid. Despite that, USA fully vaccinated stands at 63%, not bad compared to other large countries, but well behind the best among the 29 countries monitored for this report (see Figures 9A and 9B above). The highest vaccination cohort in USA is those 65 and above, with 89% fully vaccinated.

A year ago we were debating lock-downs. Today with many states moving rapidly toward full opening, the debate is whether things are moving too quickly, motivated more by politics than public health. It is clear USA is still far below other countries in total vaccination, still regarded as the best defense.

As the richer countries with access to more resources make progress, the global situation has raised issues of equity and fairness within and between countries. Even as the U.S. and other countries launched large scale vaccine distribution to a needy world community, the immensity of the need is so great that a common refrain heard now is whether this aid is too little, too late. As COVID fades into a bad memory in countries able to provide help, will the sense of urgency remain high enough to produce the results needed to end this global pandemic?

Maintaining Perspective

In the tendency to turn everything into a binary right-wrong or agree-disagree with science or government, we ignore the need to recognize the nature of science and the fact that we are dealing with very complicated issues. So, in addition to recommending excellent sources like the Centers for Disease Control and Prevention (CDC), it is also wise to consider multiple qualified sources.

While there has been much focus placed in trusting "the science," it is important to recognize that science itself changes over time based on research and available data. In the highly volatile political atmosphere we find ourselves in (not just in the U.S., but around the world), there is a danger of not allowing the experts to change their views as their own understanding expands, or of trying to silence voices of experts whose views are out of sync with "the science" as reported by the majority of media outlets.

In an earlier report, I mentioned the Greater Barrington Declaration, currently signed by more than 62-thousand medical & public health scientists and medical practitioners (and 863-thousand "concerned citizens"), which states "As infectious disease epidemiologists and public health scientists we have grave concerns about the damaging physical and mental health impacts of the prevailing COVID-19 policies, and recommend an approach we call Focused Protection."

For a personal perspective from a scholar and practitioner who espouses an approach similar to the Focused Protection of the Greater Harrington Declaration, see comments by Scott W. Atlas, Robert Wesson Senior Fellow at the Hoover Institution at Stanford University, in an article "Science, Politics, and COVID: Will Truth Prevail?"

Several months ago on SeniorLifestyle I posted an article by Mallory Pickett of The New Yorker, "Sweden's Pandemic Experiment," which provides a fair evaluation of the very loose protocols adopted by Sweden, essentially a variation of the "Focused Protection" approach. The "jury is still out" on this one, so judge for yourself whether Sweden hit the mark any better than the area in which you live.

UPDATE ON SWEDEN: As of early February, Sweden reported nearly 2.4-million cases of COVID, or 23.5% of its population of 10.2-million. There have been 17,479 deaths, for a mortality rate of 0.7%. Cases went up 4% over January and the mortality rate remained at 0.7%. Ranked 89 by population, Sweden was #39 in cases and #45 in deaths (down five ranks in cases and up one in deaths since last month). Hospitalization fell 21% in February, from 1,994 to 1,567, compared to a 282% increase last month and 91% in December.

That puts Sweden even with Spain in cases as a proportion of population (23.5%), with a mortality rate equal to Turkey (0.7%), near the bottom (best) among the 30 countries monitored for this report and well below the global rate of 1.4%.

FROM PANDEMIC TO ENDEMIC: After posting last month's Perspectives, I posted on SeniorLifestyle an article by Sarah Zhang from The Atlantic, "America Has Lost the Plot on COVID." In it, she suggests that America (and the world) is headed not toward the eradication of COVID-19, but its transformation from pandemic to endemic, joining the seasonal flu as something we will deal with for some time. Getting there, she contends, is more a matter of mixed policy strategies than "following the science," but coming to grips with its inevitability could help lead to more effective strategies.

Zhang mentions Denmark as a counterpoint to what is happening in America, saying

One country that has excelled at vaccinating its elderly population is Denmark. Ninety-five percent of those over 50 have taken a COVID-19 vaccine, on top of a 90 percent overall vaccination rate in those eligible. (Children under 12 are still not eligible.) On September 10, Denmark lifted all restrictions. No face masks. No restrictions on bars or nightclubs. Life feels completely back to normal, says Lone Simonsen, an epidemiologist at Roskilde University, who was among the scientists advising the Danish government. In deciding when the country would be ready to reopen, she told me, “I was looking at, simply, vaccination coverage in people over 50.” COVID-19 cases in Denmark have since risen—under CDC mask guidelines, the country would even qualify as an area of “high” transmission where vaccinated people should still mask indoors. But hospitalizations are at a fraction of their January peak, relatively few people are in intensive care, and deaths in particular have remained low.

Crucially, Simonsen said, decisions about COVID measures are made on a short-term basis. If the situation changes, these restrictions can come back—and indeed, the health minister is now talking about that possibility. Simonsen continues to scrutinize new hospitalizations everyday. Depending on how the country’s transition to endemicity goes, it could be a model for the rest of the world.

UPDATE ON DENMARK: In early March, Denmark reported 2.7 million cases of COVID or 46% of its population of 5.8 million. That is an increase of 1 million cases in a month, or 58%. Cases are up from 497 thousand in November, or 8% of the population. Deaths increases by 1,040 from January to 4,830 (21%), for a mortality rate of 0.2%, the same as last month. Denmark was #37 in cumulative cases and #85 in deaths (from #40 and #91 last month). Hospitalizations rose 82%, from 967 to 1,762, but that is down from December where the increase was 128%.

Denmark's case-to-population proportion is more than eight times the global rate of 5.4% and far above

the 37% of Netherlands, the worst among the 30 countries monitored for this report. Despite that, it's mortality rate remains striking. At 0.2% it is below Netherlands, whose 0.3% is the lowest among the motored countries. Both countries, then, illustrate a seeming irony pairing super high case rates with extremely low mortality rates. Does this prove the point of Zhang's observation about focusing on the prevention of hospitalization? Of course, as argued for USA, more cases lead to more deaths, even when the mortality rate is extremely low.

How we evaluate the many approaches used to deal with COVID will determine how we prepare for and approach the next global event—including what now appears to be a transition from pandemic to endemic for COVID-19.

My purpose in mentioning these sources is to recognize that there are multiple, sometimes conflicting, sometimes dissenting, voices that should be part of the conversation. The purpose of these monthly reports remains first and foremost to present the numbers about COVID-19 in a manner that helps you understand how the pandemic is progressing and how the U.S. compares to the world—and how to gain more perspective than might be gathered from the news alone.

Profile of Monitored Continents & Countries

(Data from worldometers.info).

| Rank | Country | Population | Share of World Population |

Density People per square km |

Urban Population |

Median Age |

| WORLD | 7.82B | 100% | -- | -- | -- | |

| Top 10 Countries by Population, plus Five Major Continents See lists of countries by continent |

||||||

| - | ASIA | 4.64B | 59.3% | 150 | 51 countries | 32 |

| 1 | China | 1.44B | 18.4% | 153 | 61% | 38 |

| 2 | India | 1.38B | 17.7% | 454 | 35% | 28 |

| - | AFRICA | 1.34BM | 17.1% | 45 | 59 countries | 20 |

| - | EUROPE | 747.7M | 9.6% | 34 | 44 countries | 43 |

| - | S AMERICA | 653.8M | 8.4% | 32 | 50 countries | 31 |

| - | N AMERICA | 368.9M | 4.7% | 29 | 5 countries | 39 |

| 3 | USA | 331.5M | 4.3% | 36 | 83% | 38 |

| 4 | Indonesia** | 274.5M | 3.5% | 151 | 56% | 30 |

| 5 | Pakistan* | 220.9M | 2.8% | 287 | 35% | 23 |

| 6 | Brazil | 212.9M | 2.7% | 25 | 88% | 33 |

| 7 | Nigeria* | 206.1M | 2.6% | 226 | 52% | 18 |

| 8 | Bangladesh* | 165.2M | 2.1% | 1,265 | 39% | 28 |

| 9 | Russia | 145.9M | 1.9% | 9 | 74% | 40 |

| 10 | Mexico | 129.3M | 1.7% | 66 | 84% | 29 |

| *these countries do not appear in the details because they have not yet reached a high enough threshold to be included **Indonesia was added to the monitored list in July 2021 Other Countries included in Analysis most have been in top 20 of cases or deaths |

||||||

| Rank | Country | Population | Share of World Population |

Density People per square km |

Urban Population |

Median Age |

| 11 | Japan (5) | 126.5M | 1.6% | 75 | 92% | 48 |

| 13 | Philippines (2) | 109.6M | 1.4% | 368 | 47% | 26 |

| 17 | Turkey | 84.3M | 1.1% | 110 | 76% | 32 |

| 18 | Iran | 83.9M | 1.1% | 52 | 76% | 32 |

| 19 | Germany | 83.8M | 1.1% | 240 | 76% | 46 |

| 21 | United Kingdom | 67.9M | 0.9% | 281 | 83% | 40 |

| 22 | France | 65.3M | 0.8% | 119 | 82% | 42 |

| 23 | Italy | 60.4M | 0.8% | 206 | 69% | 47 |

| 25 | South Africa (1) | 59.3M | 0.8% | 94 | 67% | 28 |

| 29 | Colombia | 50.9M | 0.7% | 46 | 80% | 31 |

| 30 | Spain | 46.8M | 0.6% | 94 | 80% | 45 |

| 32 | Argentina | 45.2M | 0.6% | 17 | 93% | 32 |

| 35 | Ukraine (1) | 43.7M | 0.6% | 75 | 69% | 41 |

| 39 | Poland (1) | 37.8M | 0.5% | 124 | 60% | 42 |

| 39 | Canada | 37.7M | 0.5% | 4 | 81% | 41 |

| 43 | Peru | 32.9M | 0.4% | 26 | 79% | 31 |

| 45 | Malaysia (3) | 32.4M | 0.4% | 99 | 78% | 30 |

| 61 | Romania (4) | 19.1M | 0.2% | 84 | 55% | 43 |

| 63 | Chile | 19.1M | 0.2% | 26 | 85% | 35 |

| 67 | Ecuador | 17.6M | 0.2% | 71 | 63% | 28 |

| 69 | Netherlands (1) | 17.1M | 0.2% | 508 | 92% | 43 |

| 80 | Bolivia | 11.7M | 0.1% | 11 | 69% | 26 |

| 81 | Belgium | 11.6M | 0.1% | 383 | 98% | 42 |

(1) Added to the monitored list in July 2021 |

||||||

Scope of This Report

What I track

From the worldometers.info website I track the following Categories:

- Total Cases • Cases per Million

- Total Deaths • Deaths per Million

- Total Tests • Tests per Million (not reported at a Continental level)

- From Cases and Deaths, I calculate the Mortality Rate

Instead of reporting Cases per Million directly, I try to put raw numbers in the perspective of several key measures. These are a different way of expressing "per Million" statistics, but it seems easier to grasp.

- Country population as a proportion of global population

- Country cases and deaths as a proportion of global cases and deaths

- Country cases as a proportion of its own population

- Cases and deaths expressed as "1 in X" number of people

Who I monitor

My analysis covers countries that have appeared in the top-10 of the worldometers categories since September 2020. This includes most of the world's largest countries as well as some that are much smaller (see the chart in the previous section).

This article was also posted on SeniorLifestyle, which I edit

Search all articles by Stu Johnson

Building article list (this could take a few moments) ...

Building article list (this could take a few moments) ...Stu Johnson is owner of Stuart Johnson & Associates, a communications consultancy in Wheaton, Illinois focused on "making information make sense."

• E-mail the author (moc.setaicossajs@uts*)* For web-based email, you may need to copy and paste the address yourself.

Posted: March 66, 2022 Accessed 4,507 times

![]() Go to the list of most recent InfoMatters Blogs

Go to the list of most recent InfoMatters Blogs

![]() Search InfoMatters (You can expand the search to the entire site)

Search InfoMatters (You can expand the search to the entire site)

Loading requested view (this could take a few moments)...

Loading requested view (this could take a few moments)...InfoMatters

Category: Information / Topics: History • Information • Statistics • Trends

COVID-19 Perspectives for February 2022

by Stu Johnson

Building article list (this could take a few moments)...

Building article list (this could take a few moments)...Posted: March 66, 2022

Have we seen the last giant gasp of the COVID pandemic as it morphs into an endemic, or are we rushing too quickly to return to normal? What happens in March will answer that question…

Putting the COVID-19 pandemic in perspective (Number 20)

This monthly report was spawned by my interest in making sense of numbers that are often misinterpreted in the media or overwhelming in detail (some would say that these reports are too detailed, but I am trying to give you a picture of how the COVID pandemic in the United States compares with the rest of the world, to give you a sense of perspective).

These reports will continue as long as the pandemic persists around the world.

Report Sections:

• February-at-a-glance

• The Continental View • USA Compared with Other Countries

• COVID Deaths Compared to the Leading Causes of Death in the U.S.

• U.S. COVID Cases versus Vaccinations

• Profile of Monitored Continents & Countries • Scope of This Report

January-at-a-glance

Reminder: you can click on any of the charts to enlarge it. It will open in another tab or window. Close it to return here.

GLOBAL SNAPSHOT

As of this writing, in early March, the attention of the world has turned toward the Russian invasion of Ukraine, while in many places the masks for COVID are coming off. Yet, looking at the February numbers (Figure 1), the Omicron variant was still very active around the world, most notably in Europe and North America. However, with hospitalizations down and mortality rates continuing to fall (because, fortunately, deaths have not kept pace with cases), it does feel like we're finally seining the pandemic's last gasp—while there could be more variants and renewed surges, it appears that COVID may be on its way to becoming endemic, a reality we will continue to deal with, but on a more manageable scale. Let's see if the numbers for February help support that viewpoint.

EXECUTIVE SUMMARY

- Global CASES reached 436-million by the end of February, an 18% increase. That's big, but a little more than half of the huge 31% surge in January. The percentage of the global population with reported cases of COVID-19 rose from 3.6% in December, to 4.8% last month, and ended February at 5.5%. (The 1918 pandemic is generally thought to have infected 25% of the global population).

The red "cone" in Figure 1 above shows a high and low projection of global cases, based on the pace of spread in the first year of COVID-19. The bottom (roughly 190-million represents the trajectory of the lower pace in late summer 2020; the upper (approximately 360-million) represents a continuation of the major surge from November 2020 through January 2021. Even with the delta variant in 2021 was announced with alarm, the global increase in cases stayed within the projection cone. Then came omicron, which hit Europe hard in December 2021, then shot the curve through the projection cone in January, soaring upward by 88-million cases. February slowed slightly, adding another 60-million cases worldwide. That put the curve for global cases about 70-million higher than my projection cone based on the situation a year ago.

- DEATHS from COVID around the world continued to rise at a much slower pace than cases. February deaths were 5% above January, compared to 4% the previous three months. However, if you put a straight edge on the curve from March to June 2021, you will see that the rate of increase in deaths has fallen off significantly.

- BY CONTINENT. At the global level, omicron produced a noticeable but relatively small bend in the curve for cases as a proportion of population (Fig. 3C), because Asia and Africa—the two largest continents—barely budged. That was not the case with the other continents. South America, which had been slowing and nearly flat at the end of 2021, bent upwards significantly in January and February. Europe and North America shot upward at a startling rate—Europe from 11.6% of its population having contacted COVID by the end of December to 20.8% by the end of February. North America, far ahead of Europe to begin with, leaped from 17.6% at the end of December, to 23.8% in January, then "slowed" to end February with 25.5% of its population having been reported with COVID since the pandemic began nearly two years earlier—matching the 1918 pandemic in proportion of cases.

- USA continues to lead the world in the number of reported cases and deaths, and while it leads the world in the number of COVID tests its vaccination rate remains lackluster compared to South America.

USA cases soared 37% in January, to 75.6-million or nearly 23% of the population, then February slowed, bringing the proportion to 24.3% of its population. At the same time, four European countries that had been tracking fairly close to USA began to move even higher when omicron struck, increasing their spread even more in February, with Netherlands the highest, at 37% of its population reported with COVID.

The blue projection cone surrounding USA cases in Figure 1, based on the same timeline as the global cone described above, stretched from 35 to 115 million cases, with the curve for cases staying well within those bounds. Cases in USA flattened significantly from January through July 2021 after vaccinations became available, Then, it rose slightly through November with a combination of delta and vaccine resistance. Omicron produced a serious upward bend last month, but slowed in February, ending the month at about the mid-point in the cone.

The upward bend for USA cases from August 2021 to January 2022 is clearly visible in Figure 1, but even more pronounced in Figure 10 below, which "zooms in" on USA. Figure 11 provides a detailed view of USA vaccination.

Figure 1 also shows how much lower cases in USA would be—approaching 17-million by now, instead of 81-million—if they were proportional to the global population. It would also mean about 255-thousand deaths instead of approaching 1 million..

USA deaths continues to represent a proportion of world COVID deaths far in excess of its 4% share of world population. (China and India represent roughly one-third of world population between them). USA deaths declined from 20.9% of the world total in September 2020 to 14.5% at the end of August 2021, before inching up each month since then, ending February with deaths at 16.3% of the world total.

- THE OMICRON VARIANT emerged at the end of November 2021 and hit Europe hard, bringing back lockdowns and severe restrictions in several countries. In January the surge became turbo-charged and spread to North America and to a lesser but noticeable extent to South America and Asia. The global omicron surge (still focused largely on Europe and North America) slowed only slightly in February, while in USA it slowed more noticeably. While deaths can follow well behind increases in cases, it appears that both delta and omicron have had minimal impact on the pace of COVID deaths as mortality rates (deaths as a proportion of cases) continue to fall.

- TESTING. USA leads in the number of tests, with 898-million, followed by India, UK, Russia and France. Of the 30 countries monitored for this report, Romania, Ukraine, Mexico, Bolivia and Ecuador report the lowest number of tests. By proportion of population (tests-per-million), UK remains far ahead of others, with the equivalent of 7 tests per person. USA is about 3 tests per person, similar to the other top countries. At the low end, the number of tests covers 29% or less of population. (See figures 8A, 8B, 8C, and 8D). With home tests available more widely since last month, it will be hard to see their impact on the overall amount of testing, since their use is not reported to health agencies.

- VACCINATIONS. 63% of the world's population have been reported as receiving at least one dose of vaccine by the end of February. (See figures 5A, 5B, 5C, 9A, 9B and 11).

South America leads the world in vaccination, with Chile reporting 89% fully vaccinated. USA continues to move ahead, but slowly, with 65% fully vaccinated at the end of February and another 11% partially vaccinated.

- COUNTRIES TO WATCH. Japan was added to the list of countries monitored for this report as it appeared in the top-20 for number of cases in February. That brings the number of countries on the list to 30 (see the table at the end of this report for a profile of the monitored countries).

The weekly comparison report on worldometers.info gives a sense of hot spots to watch. Based on weekly activity, this includes South Korea, Vietnam, Hong Kong, Austria, Australia, and Thailand—all in the top 20 of new cases and/or deaths in the last week of February. While some of these have populations too small to make much of an impact on this report, they generally confirm (along with countries recently added to my monitored list) that the recent focus on Europe is broadening out again as omicron spread more widely.

Where you get information on COVID is important. In an atmosphere wary of misinformation, "news-by-anecdote" from otherwise trusted sources can itself be a form of misinformation. As I go through the statistics each month, I am reminded often that the numbers do not always line up with the impressions from the news. With that caveat, let's dig into the numbers for January 2022.

THE CONTINENTAL VIEW

The most obvious trend in February is the continued surge in COVID cases in Europe and North America. Oceana is not included because of its small size, about one-half a percent of world population.

While COVID-19 has been classified as a global pandemic, it is not distributed evenly around the world.

COVID cases now represent 5.4% of world population. (By the end of the 1918 pandemic, it is generally reported to be about one-quarter of the population.) Where Asia and Africa combined represent about three-quarters (76.9%) of the world's 7.9-billion people, Europe, South America and North America still account for 7 in ten COVID cases (70.4% - Figure 3A) and nearly three-quarters of COVID deaths (73.2% - Figure 4A).

The major trend in February was the continued massive surge in Europe due to the omicron variant. After four months at 25 to 26% of world cases, Europe's share kept pushing higher, ending February at 35.7%. Even though omicron produced surges on other continents, the impact was blunted because of Europe: South America continued a decline in proportion of world cases that started in June and North America reversed a noticeable upward bump in January, with February back to 21.7%, a level not seen since June. Asia and Africa combined have been dropping in proportion since September, with a significant shrinkage in January that continued into February.

Overall, Europe is up 8% in COVID cases since the chart begins in November 2020*, while Asia is virtually unchanged and the others down: Africa 1%, North America 4% and South America 5%.

* After months of emphasizing mitigation and :"flattening the curve," which seemed to be working through mid-2020, November of 2020 marked the beginning of a major

worldwide surge that would extend through January 2021 (when vaccines became available). This surge marks the upper edge of my projection cone in Fig, 1.

Omicron left no doubt that it was real and widespread in January and just as strong in February in Europe, Asia and South America. Only North America showed a downturn and Africa remained remarkably detached, despite having the second largest population after Asia .. .

Europe shows the greatest impact in number of cases, nearly doubling, from 87 million in December to 156 million in February. Asia matched Europe in cases in December, but its omicron surge was a bit more restrained, but still went up in a straight line to 116 million. North America shot up dramatically in January, but slowed in February, ending at 95 million. (If it increased at the same pace as January, it would have caught up with Asia. South America, which had flattened considerably in the closing months of 2021, had its own straight line surge in January and February, moving from 40 to 54 millions cases.

The raw numbers of Fig. 3B can be deceptive. Fig. 3C gives a more realistic picture of the impact by translating raw case numbers to percentage of population. The shape of the curves is similar to those for raw numbers, but the order and spacing paints a different picture.

The impact of Omicron in January and February is clearly shown, with the global share of COVID cases increasing from 3.6% to 5.5%. Europe saw the biggest increase, climbing steadily both months, but North America remains on top, even though it slowed significantly in February. South America, which had been practically flat since August, increased steadily both months, but stays much closer to the global level. Asia shows a slight upward bend, while Africa shows virtually no change, both remaining below the global level. .

The proportion of deaths between continents shows less extreme change than that for cases. In fact, given the radical change in cases for Europe in the past three months (Fig. 3A), the continental share of COVID deaths has remained remarkably stable. The changes in Fig. 4A can be divided into three sextons (the pattern is similar in Fig. 3A for cases, but not as clear as it is here):

- November 2020 to March 2021 - Europe and North America expand as Asia and South America contract.

- April to July 2021 - Asia and South America expand as Europe and North America contract

- August 2021 - February 2022 - Europe and North America expand as Asia and South America contract

Overall, Asia is up 3% in proportion of COVID deaths from where the chart starts in November 2020, Europe is up 2%, Africa is up 1%, while South America is down 1% and North America down 4%.

Deaths through February 2022 show that while the trajectory lags behind cases and has progressed at a steadier rate, it does reflect the overall changes in Cases by continent. Except for Africa, which is well below the other continents in the number of COVID deaths, for the other four the 1-million milestone has been in the rear view mirror for months.

While the omicron surge in Europe went "through the roof," what is interesting here is that the death rate actually took a turn downward in January, with a very slight upturn in February. Part of that is explained by the lag between cases and deaths, but the relative steadiness in the path of each curve shows that the death rate has remained much more constant over time than cases and, as we'll see later, mortality rates (deaths as a proportion of cases) continue to fall.

Vaccinations

As Fig. 5A shows, nearly two thirds of the global population (63%) has been reported with at least one dose of vaccine, and more than half (56%) are fully vaccinated. That is still well below what is commonly thought of for "herd immunity," which is closer to 94% of the population being immune (most through vaccination), but is remarkable nonetheless given the enormity of the effort represented in just over a year since vaccines became available.

South America, which was slow to get into testing and vaccination, soared ahead of the other continents toward the end of 2020, taking the lead in total vaccine doses in August 2021. While North America is second in overall vaccinations, it is fourth in those who are fully vaccinated. The proportion of partial vaccinations in North America has risen faster than full vaccinations showing that omicron may have provided the incentive for some vaccine resisters to get their first dose.

While South America got into vaccinations later and slower than North America and Europe, Figure 5B shows how it steadily pushed its way to the top of total vaccination doses administered by August 2021, expanding its lead since then—and this by proportion of population, not raw numbers, so it's a fair comparison. Where North America started aggressively, it slowed in June as Europe and Asia caught up, with Asia barely ahead of North America at the end of February (72% vs 71%). Europe ended February at 68% of its population receiving at least one dose of vaccine.

Where South America continues to push upwards toward 90%, Asia, North America and Europe have all slowed, increasing only 1% over January and falling about 10 points behind South America/ Combined with the still very low proportion of African vaccination, the global curve stayed below two-thirds (63%) in February.

COMPARISON OF USA WITH OTHER COUNTRIES

Cases

Raw numbers are virtually meaningless without relating them to the size of a given country, so looking at cases as a proportion of population helps get a sense of the relative impact. The countries with the greatest proportion of COVID cases illustrates how they amplify what is barely noticeable in the world trend for cases (bottom line in Figure 6A),

The same five countries have been in the top-5 for four months, only shifting in order. In mid-2021, Brazil, Argentina and Columbia were in the top-five, but since October it has been dominated by Europe and USA.

As we saw in the continental view, omicron left its unmistakable imprint on the rise in proportion of COVID cases. While USA leads in number of cases, it is last in the top-5 by proportion of population, ending February with close to one-quarter of its population having been reported with COVID. Much smaller in geography and population, Netherlands now has seen more than a third of its population (37%) reported with COVID.

Another way to look at population proportion is the measure "1 in." The global figure of 5.5% means that 1 in 18 people in the world have been reported with COVID-19 since it began (and that only by official record keeping, not including any unreported and likely asymptomatic cases). For USA and UK it is 1 in 4; for the other three in the top-5 it is 1 in 3. 19 of the 30 monitored countries are now at a proportion of 10% or more, meaning 1 in 10 or fewer.

All five countries (of the 30 monitored) in the bottom-5 by proportion of population have been there since September 2021.

At the scale of this chart, the rise in Global case proportion is magnified compared to the previous chart, so it clearly shows the acceleration of cases produced by omicron around the world since November.

These countries represent a considerable spread in size, from India, the second largest country, to Ecuador, ranked number 67 of the 215 countries tracked by worldometers. For Ecuador, its 4.7% of population means that 1 in 21 have been reported as having had the COVID virus; for India it is 1 in 32, and for Indonesia 1 in 49.

Because the size of countries makes the use of raw case numbers illusory, another measure I find helpful is the rate of change from month to month (Figure 6C). The focus of the selection is on recent changes, but the chart goes back to March 2021, which shows the first major surge fading as vaccinations began.

For this chart, countries are selected based on the change over two-months (end of December to the end of February for this report). For the chart this month Germany and Netherlands replace Belgium and Canada.

The overall trend (red line, reflecting global level) had been falling as the global level reached 6% (of change over the previous month) in November, but omicron pushed it back up to 31% by the end of January before settling back to 16% at the end of February.. (The trend line smooths out more rapid month-to-month changes).